- Netherlands

- /

- Metals and Mining

- /

- ENXTAM:AMG

AMG Critical Materials (ENXTAM:AMG): €60M One-Off Loss Challenges Recent Bullish Narratives on Valuation

Reviewed by Simply Wall St

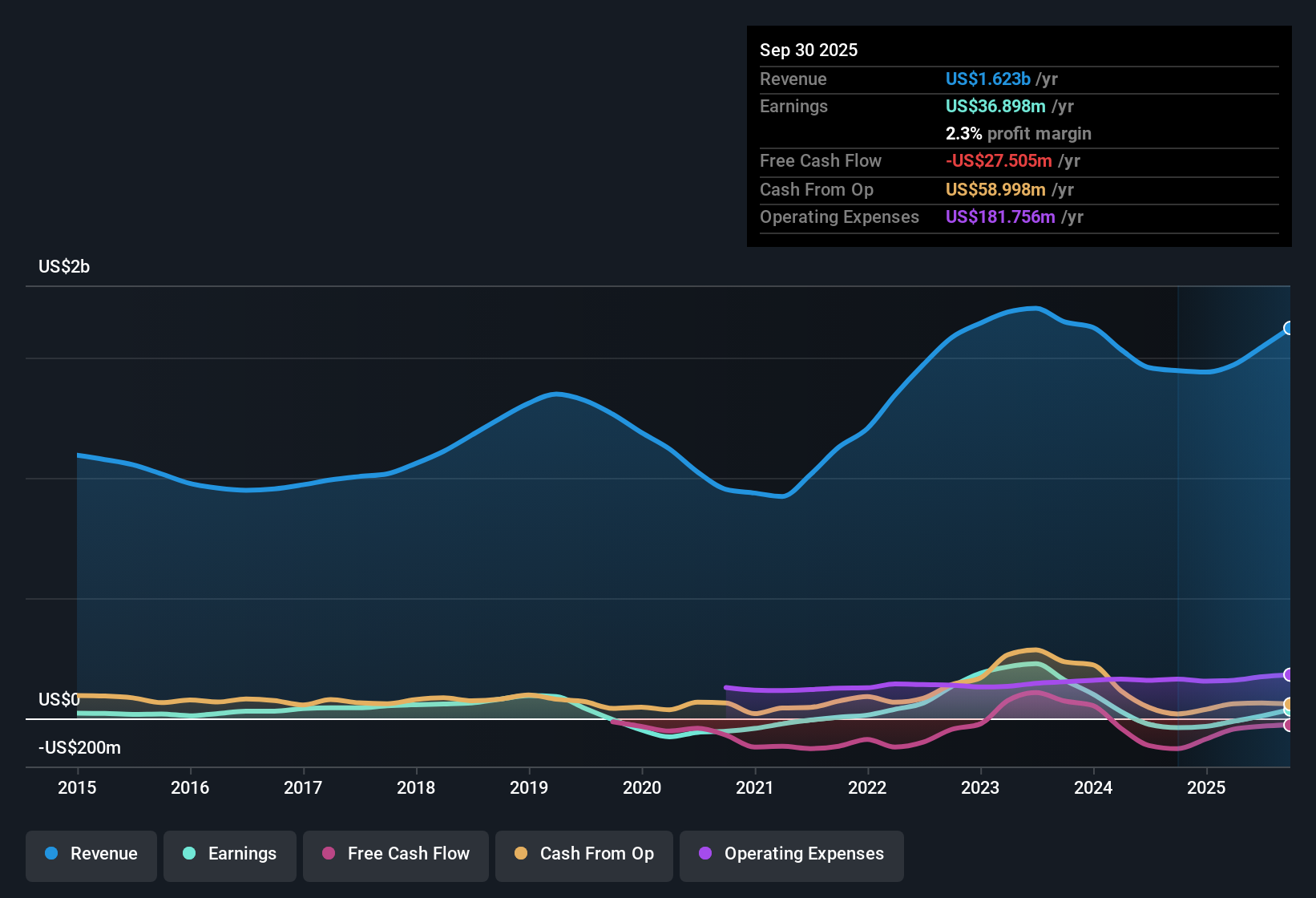

AMG Critical Materials (ENXTAM:AMG) posted a strong set of headline numbers, with earnings forecast to grow 39.9% per year, well ahead of the Dutch market’s 11.2% growth rate. Revenue, meanwhile, is expected to rise 4.7% annually, trailing the broader market’s 7.8%. The company has recently returned to profitability and has grown earnings by 7.4% per year over the past five years, but reported a $60.0 million one-off loss for the year ending September 30, 2025. Despite the setback, shares trade at €26.62, substantially below the estimated fair value of €68.17, offering investors a combination of rapid forecast profit growth and a price tag well under analyst expectations.

See our full analysis for AMG Critical Materials.Next, we’ll compare these earnings results to the leading market narratives to see which stories hold up and which ones might need a rethink.

See what the community is saying about AMG Critical Materials

Margin Expansion Potential Despite Just 0.7% Base

- Analysts expect AMG's profit margin to climb from 0.7% today to 8.5% within three years. If achieved, this would represent a more than tenfold improvement in underlying profitability.

- According to the analysts' consensus view, several factors are set to drive this surge in margins, including newly ramped lithium refining capacity in Europe and successful renewals of key feedstock agreements.

- Expanded lithium production and recycling investments are positioned to boost both supply chain resilience and net margins over the medium term.

- If operational bottlenecks are resolved, consensus believes AMG can benefit from premium pricing and enhanced top-line stability. Margin expansion is regarded as the central driver for future earnings upgrades.

- Consensus notes that even with these positive trends, operational risks such as equipment reliability and high capital expenditure requirements remain. The projected margin gains will need to be monitored closely as new assets come online.

- Click to see if analysts believe AMG’s margin transformation is already priced in, and if this growth story stands out among its global peers: 📊 Read the full AMG Critical Materials Consensus Narrative.

Temporary Inventory Gains Cloud Segment Profitability

- This past quarter, AMG’s Antimony segment was temporarily lifted by selling low-cost inventory at higher spot prices. Management flagged this as a non-recurring benefit, unlikely to repeat in coming periods.

- Bearish commentators highlight the risk that, once this inventory windfall fades, segment profitability will retreat toward more modest norms unless broader market conditions for metals and catalysts improve.

- Consensus already identifies persistent volatility in key products such as lithium and vanadium as ongoing headwinds that could depress future cash flow.

- Additional concerns include elevated working capital tied up in raw materials and ongoing operational challenges. Both factors could prolong pressure on segment margins after this quarter’s boost.

Premium Price Tag Versus Industry and Peers

- At a Price-to-Earnings ratio of 26.8x, AMG trades well above both the European metals and mining sector average of 15.5x and the peer group average of 19.4x, even as it sits just below the DCF fair value of €68.17 per share.

- Analysts' consensus view suggests that this valuation premium depends on AMG delivering sustained profit growth and successful execution of new capacity ramp-ups.

- Any setbacks in cash flow, unexpected costs, or failure to meet forecast margin gains could trigger a swift rerating. The current share price of €26.62 is already above the consensus analyst price target of €32.70 but remains under the DCF fair value.

- Consensus believes investors are weighing the upside from anticipated margin and earnings growth against the premium multiple and operational risks. As a result, future performance monitoring is seen as critical for justifying AMG’s current valuation.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for AMG Critical Materials on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think there’s more to the numbers? Share your perspective and shape your unique narrative about AMG in just a few minutes. Do it your way.

A great starting point for your AMG Critical Materials research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

AMG faces lingering risks from volatile cash flow, operational challenges, and a premium valuation that depends on margin improvements materializing as forecast.

If you would rather focus on stocks trading below their fair value with greater upside, check out these 836 undervalued stocks based on cash flows as a smarter way to spot hidden opportunities in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:AMG

AMG Critical Materials

Develops, produces, and sells energy storage materials.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives