- Netherlands

- /

- Metals and Mining

- /

- ENXTAM:AMG

Shareholders Of AMG Advanced Metallurgical Group (AMS:AMG) Must Be Happy With Their 193% Total Return

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on a lighter note, a good company can see its share price rise well over 100%. Long term AMG Advanced Metallurgical Group N.V. (AMS:AMG) shareholders would be well aware of this, since the stock is up 170% in five years. Also pleasing for shareholders was the 56% gain in the last three months.

View our latest analysis for AMG Advanced Metallurgical Group

Given that AMG Advanced Metallurgical Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 5 years AMG Advanced Metallurgical Group saw its revenue grow at 4.4% per year. Put simply, that growth rate fails to impress. In comparison, the share price rise of 22% per year over the last half a decade is pretty impressive. While we wouldn't be overly concerned, it might be worth checking whether you think the fundamental business gains really justify the share price action. Some might suggest that the sentiment around the stock is rather positive.

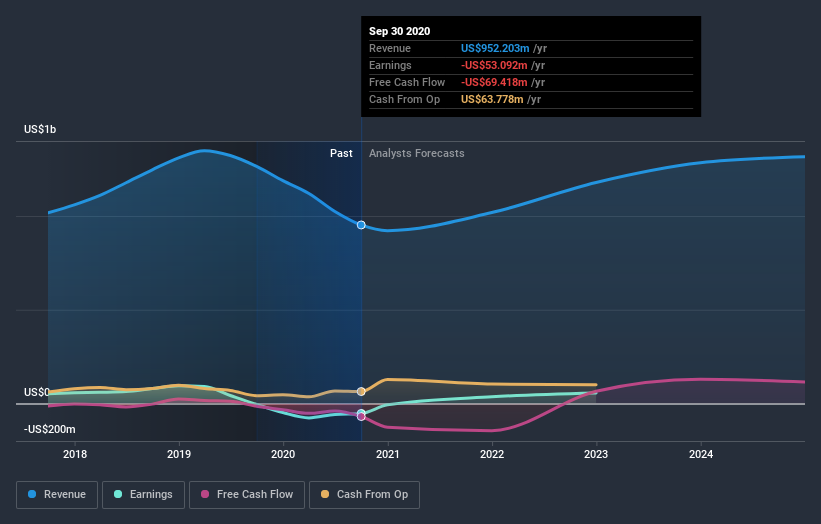

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So it makes a lot of sense to check out what analysts think AMG Advanced Metallurgical Group will earn in the future (free profit forecasts).

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for AMG Advanced Metallurgical Group the TSR over the last 5 years was 193%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that AMG Advanced Metallurgical Group has rewarded shareholders with a total shareholder return of 16% in the last twelve months. And that does include the dividend. However, the TSR over five years, coming in at 24% per year, is even more impressive. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that AMG Advanced Metallurgical Group is showing 2 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

AMG Advanced Metallurgical Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NL exchanges.

If you decide to trade AMG Advanced Metallurgical Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTAM:AMG

AMG Critical Materials

Develops, produces, and sells energy storage materials.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives