- Netherlands

- /

- Medical Equipment

- /

- ENXTAM:PHIA

Philips (ENXTAM:PHIA): Examining Share Valuation After Recent Financial Results

Reviewed by Simply Wall St

Koninklijke Philips (ENXTAM:PHIA) has seen its share price hold steady recently, with investors looking over the company’s latest financial results and ongoing business performance. Philips continues to generate discussion regarding its earnings and market position.

See our latest analysis for Koninklijke Philips.

Philips’ share price has been rangebound so far this year, reflecting mixed investor sentiment following recent results and last year's volatility. While the year-to-date share price return is down 3%, the one-year total shareholder return is modestly positive at 0.7%. Long-term holders have weathered a challenging five-year stretch, but the stock’s 111% total return over three years suggests renewed optimism and some rebuilding momentum.

If you’re considering what else is moving in the healthcare space, now is a smart moment to see the full list of innovators with our hand-picked screener: See the full list for free.

With Philips trading somewhat below analyst price targets and notable recent earnings growth, the question for investors is clear: is there hidden value in the share price, or do markets already anticipate stronger growth ahead?

Price-to-Earnings of 132.7x: Is it justified?

Philips is currently trading at a price-to-earnings (P/E) ratio of 132.7x, which stands out as significantly higher than both its peer average and industry norms. At the last close price of €23.74, Philips appears to be valued at a hefty premium compared to similar companies.

The P/E ratio measures how much investors are willing to pay for each euro of earnings. For healthcare and medical equipment firms, this ratio can indicate high expectations for future earnings or reflect a one-time earnings dip impacting the calculation.

With Philips’ P/E nearly five times the peer average (28.3x) and more than four times the broader European Medical Equipment industry average (29x), the company’s current valuation appears steep. Unless investors expect a significant turnaround in profits or future growth, such a high multiple may be difficult to sustain.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 132.7x (OVERVALUED)

However, persistent earnings volatility or weaker-than-expected revenue growth could shift sentiment and challenge the outlook that is currently reflected in Philips’ high valuation.

Find out about the key risks to this Koninklijke Philips narrative.

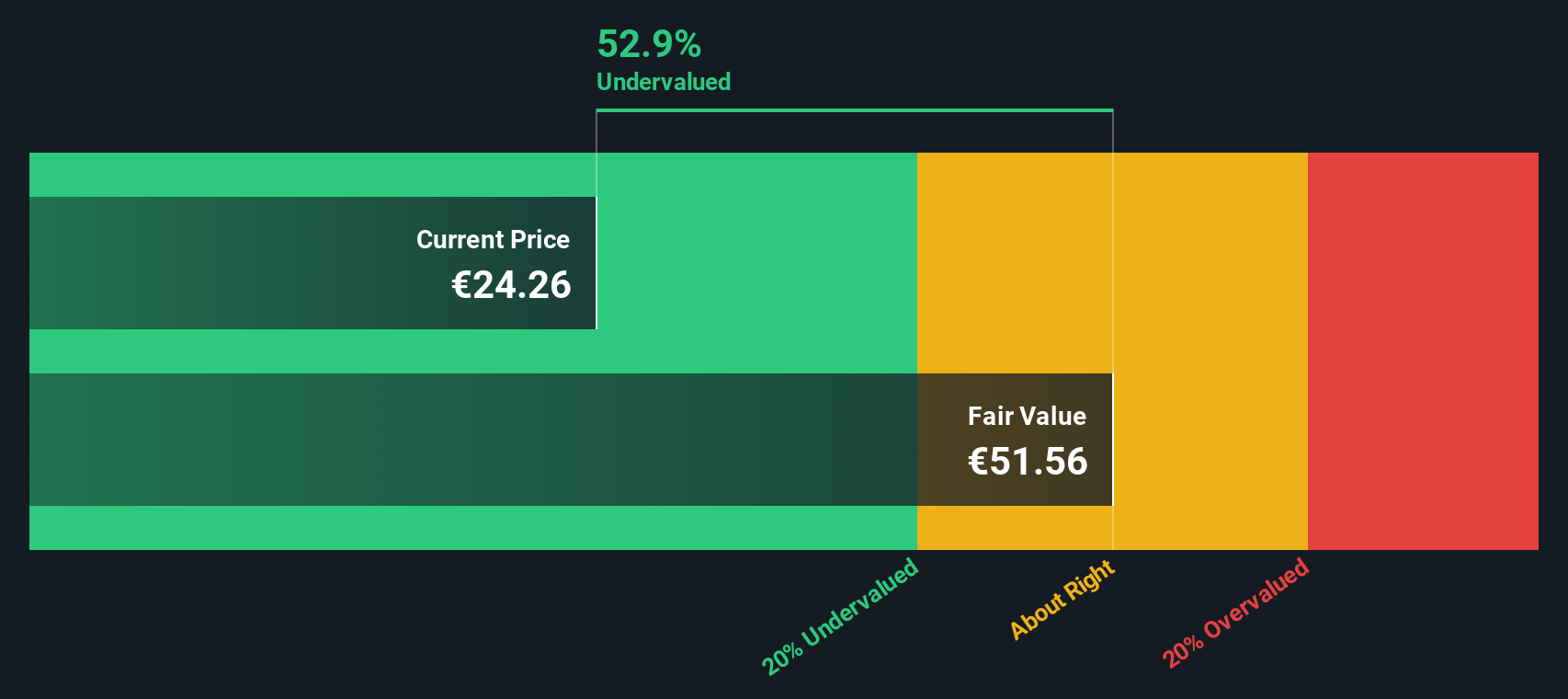

Another Perspective: Discounted Cash Flow Model Points to Value

Taking a different approach, the SWS DCF model suggests that Philips could be substantially undervalued. According to this analysis, the current price of €23.74 sits about 53% below what we estimate as its fair value of €50.47. How does this stark difference reframe the risk or opportunity at hand?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Koninklijke Philips for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Koninklijke Philips Narrative

If you're inclined to reach your own conclusions or want to dive deeper into the numbers, you can build a personalized view in just a few minutes with your own assumptions. Do it your way

A great starting point for your Koninklijke Philips research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't miss your chance to spot tomorrow’s winners before the crowd. The market is full of untapped opportunities. Your next smart move could be just a click away.

- Uncover strong cash flow potential by checking out these 840 undervalued stocks based on cash flows and see which companies the market might be overlooking right now.

- Tap into unstoppable innovation when you review these 26 AI penny stocks driving breakthroughs in artificial intelligence and shaping entirely new industries.

- Secure your portfolio’s income with these 22 dividend stocks with yields > 3% offering consistent yields and solid fundamentals for reliable, long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Philips might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PHIA

Koninklijke Philips

Operates as a health technology company in North America, the Greater China, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives