- Netherlands

- /

- Medical Equipment

- /

- ENXTAM:PHIA

Philips (ENXTAM:PHIA) €446 Million One-Off Loss Tests Bullish Turnaround Narratives

Reviewed by Simply Wall St

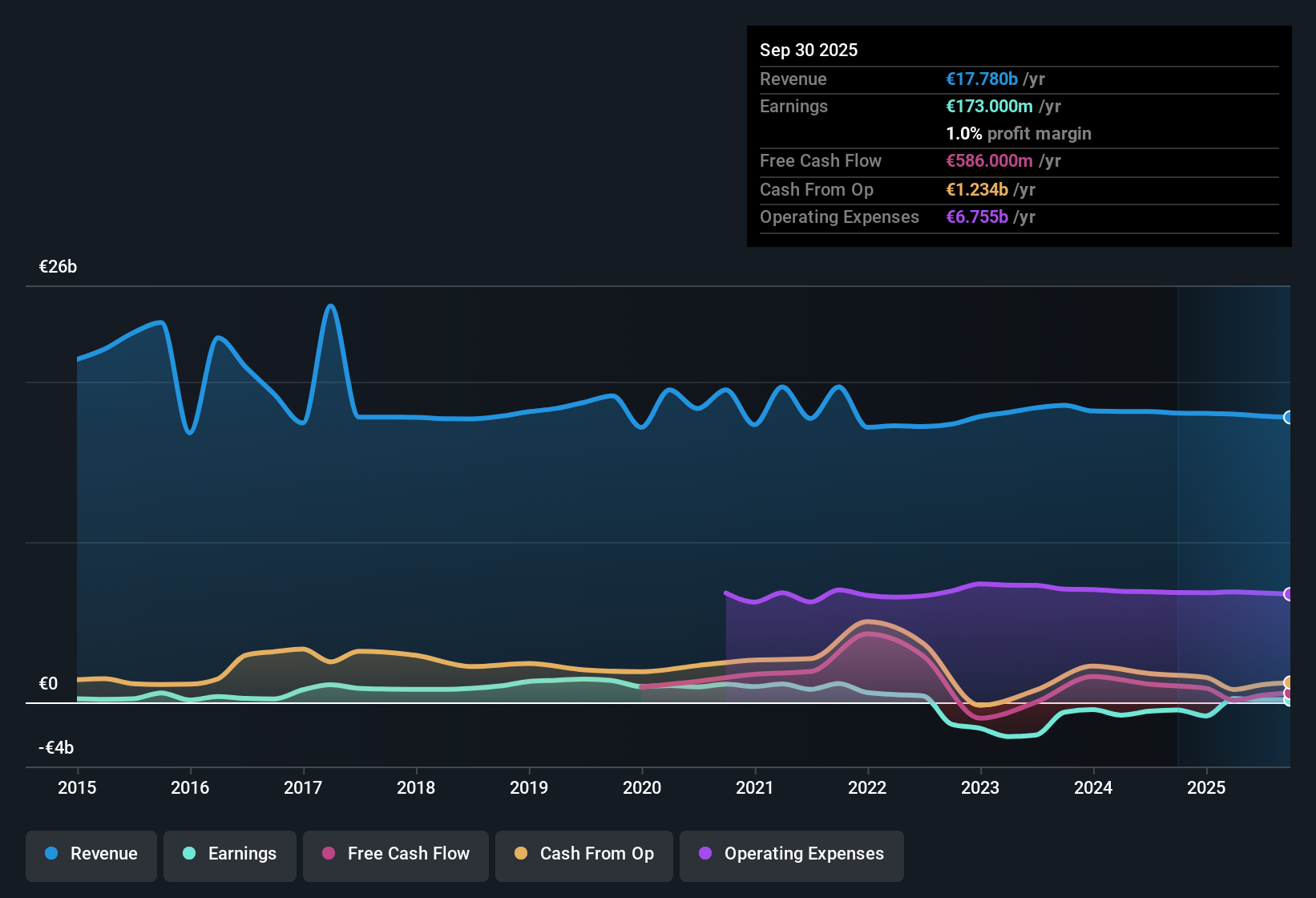

Koninklijke Philips (ENXTAM:PHIA) just reported that its revenue is forecast to grow at 4.2% per year, trailing behind the broader Dutch market’s expected 7.8% yearly pace. After averaging a sharp 34.8% annual earnings decline over the last five years, the company has flipped back to profitability this year, though a one-off loss of €446 million in the past 12 months put a notable dent in recent results. Now, analysts are betting on earnings to jump by 35.19% per year, with profit growth set to outpace the rest of the market. This could set the stage for some potentially positive momentum from here.

See our full analysis for Koninklijke Philips.The next section breaks down how these numbers compare with the major market narratives. This is where the real story gets tested.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off €446 Million Loss Impacts Profit Momentum

- Philips reported a one-off loss of €446 million for the 12 months ending 30 September 2025, significantly impacting recent profitability and offsetting some gains from the transition back to positive earnings.

- What is surprising is that, despite this sizeable setback, the prevailing market view highlights investor optimism about the company’s swift return to profitability. Bullish arguments rest on substantial earnings growth forecasts, which are expected to outpace the Dutch market, and the belief that management’s restructuring and operational focus will help the company overcome short-term turbulence.

- Investors are drawing confidence from a forecasted 35.19% annual earnings growth, which heavily supports the narrative that Philips is positioned for a sustained rebound instead of lingering losses.

- However, the one-off loss continues to loom over near-term sentiment, creating tension between past setbacks and anticipated recovery pace.

Premium 133.9x P/E Signals High Expectations

- Philips’ current Price-To-Earnings Ratio of 133.9x stands well above both the European medical equipment industry average and its immediate peers. This suggests the market is willing to pay a premium for the company’s anticipated turnaround.

- The prevailing market view points out that, while investors are paying up in anticipation of stronger growth, such a lofty valuation signals heightened expectations and leaves little room for disappointment if profitability improvements fall short.

- This tension is further heightened by the earnings dip from recent non-recurring losses, which could still weigh on sentiment if operational risks persist in future periods.

- Some investors may view this ratio as justified by forward-looking profit recovery, whereas others may argue that the premium overstates how quickly fundamentals will normalize.

Dividend Sustainability in Doubt Amid Financial Risks

- The filing indicates that Philips’ financial position is not robust, with warning signs around dividend sustainability and the ability to maintain payouts if near-term risks materialize.

- The prevailing market analysis underscores that, despite the optimism tied to projected profit growth, risks such as non-recurring losses and balance sheet weakness remain key hurdles for income-focused investors.

- Investors must recognize that recovery in reported earnings does not automatically restore the company’s ability to support a reliable dividend policy, challenging narratives that emphasize only the upside.

- This underscores the ongoing need to weigh potential gains from a growth rebound against the structural risks present in the balance sheet.

If you're weighing whether the turnaround can overcome these risks, be sure to check what the numbers are telling in the balanced narrative. 📊 Read the full Koninklijke Philips Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Koninklijke Philips's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Philips’ premium valuation and shaky balance sheet raise concerns about its financial strength and its ability to consistently deliver for shareholders.

If you want companies with stronger financial foundations, use our solid balance sheet and fundamentals stocks screener (1977 results) to focus on those built for stability and resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Philips might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PHIA

Koninklijke Philips

Operates as a health technology company in North America, the Greater China, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives