- Netherlands

- /

- Medical Equipment

- /

- ENXTAM:PHIA

Koninklijke Philips (ENXTAM:PHIA) Expands Masimo Partnership To Integrate Advanced Monitoring Technologies

Reviewed by Simply Wall St

Koninklijke Philips (ENXTAM:PHIA) experienced an 18% increase in its share price last quarter. This movement coincides with the renewal and expansion of its partnership with Masimo, a collaboration poised to enhance the integration of advanced monitoring technologies into Philips' devices. Additionally, recent market trends, including rising stock indices and anticipated interest rate cuts by the Federal Reserve, have likely added upward momentum. The broader market environment, where major indices like the Dow Jones and S&P 500 hit record highs, contributed positively. Thus, Philips' activities, alongside favorable market conditions, likely supported the company's impressive share price performance.

We've identified 2 risks for Koninklijke Philips that you should be aware of.

Over the past three years, Koninklijke Philips (ENXTAM:PHIA) has delivered a total return of 56.69%, including both share price appreciation and dividends. Despite this substantial long-term return, the stock faced recent challenges, underperforming the Dutch market's 6.3% return and the Dutch Medical Equipment industry's 3.9% decline over the past year.

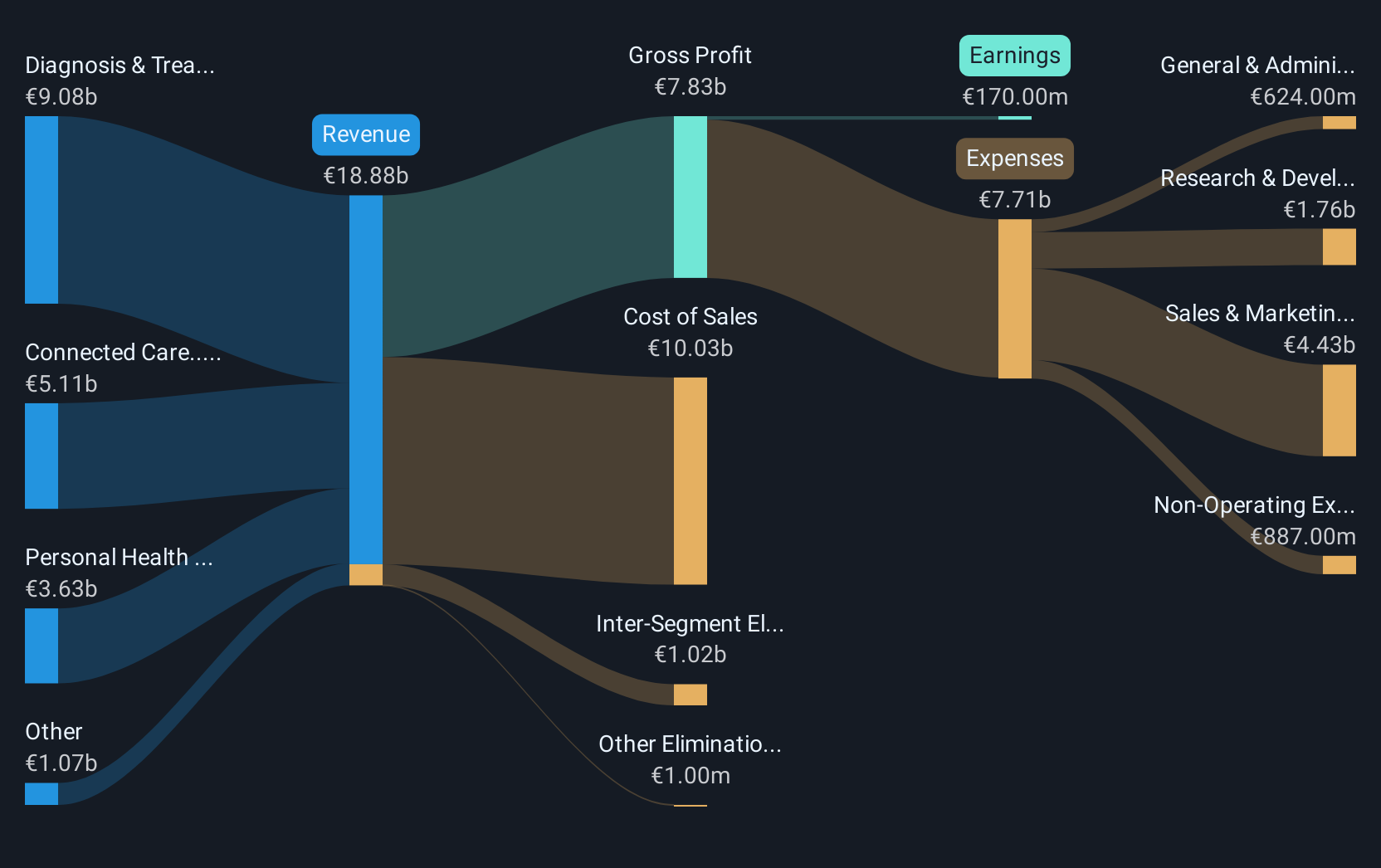

The momentum from Philips' short-term share price increase, spurred by its expanded partnership with Masimo and favorable market conditions, may influence future revenue and earnings expectations. This partnership could potentially bolster Philips' product offerings and enhance patient care, creating positive revenue impacts. However, with current earnings projection challenges, as reflected in a Price-To-Earnings Ratio of 135.1x compared to the industry average of 33.5x, cautious analysis is warranted.

Regarding valuation, the current share price of €24.17 presents a discount of approximately 11% to the consensus analyst price target of €26.82. This discount offers a context for evaluating Philips' market positioning and growth potential compared to analyst expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Philips might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PHIA

Koninklijke Philips

Operates as a health technology company in North America, the Greater China, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives