- Netherlands

- /

- Medical Equipment

- /

- ENXTAM:PHIA

Assessing Philips (ENXTAM:PHIA) Valuation After Recent Modest Share Price Movement

Reviewed by Simply Wall St

Koninklijke Philips (ENXTAM:PHIA) shares have shown minor movement lately, with a modest gain of 0.5% at the last close. Over the past month, however, the stock dipped by just over 5%.

See our latest analysis for Koninklijke Philips.

After a rocky stretch this month, Koninklijke Philips shows momentum is still searching for direction. While this week’s 5.2% share price return was negative, the company’s three-year total shareholder return remains a standout at nearly 87%. This comes despite a 12-month total return of -3%.

If you’re curious to see what else is trending in healthcare, now is a perfect opportunity to explore See the full list for free.

With shares sitting almost 15% below analyst price targets and trading at a substantial discount to some intrinsic estimates, investors have to ask whether this signals a buying opportunity or if the market is already pricing in all future growth.

Price-to-Earnings of 129.1x: Is it justified?

Koninklijke Philips currently trades with a price-to-earnings ratio of 129.1x, which is well above both its peers and the industry average. At a last close of €23.49, this high multiple signals the market’s heavy premium for expected future profits, even as share price momentum remains lackluster.

The price-to-earnings (P/E) ratio reflects how much investors are willing to pay for each euro of earnings and serves as a yardstick for value in sectors like medical equipment where earnings can be choppy or cyclically affected. In this case, the market appears to be pricing in significant growth ahead, perhaps influenced by Philips' recent return to profitability and anticipated future gains. However, such a high ratio raises questions about whether the future trajectory justifies the enthusiasm or if expectations have disconnected from near-term realities.

Compared to the peer average of 28.8x and the European industry’s 27.2x, Philips’ 129.1x P/E appears steep. Without additional guidance from a fair ratio benchmark, it is difficult to see this level converging closer to sector norms in the near future, leaving the stock potentially exposed to valuation risk if growth expectations are not met.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 129.1x (OVERVALUED)

However, sustained revenue growth could stall, or a disappointing earnings report may prompt a market reassessment of Philips’ current lofty valuation.

Find out about the key risks to this Koninklijke Philips narrative.

Another Perspective: DCF Tells a Different Story

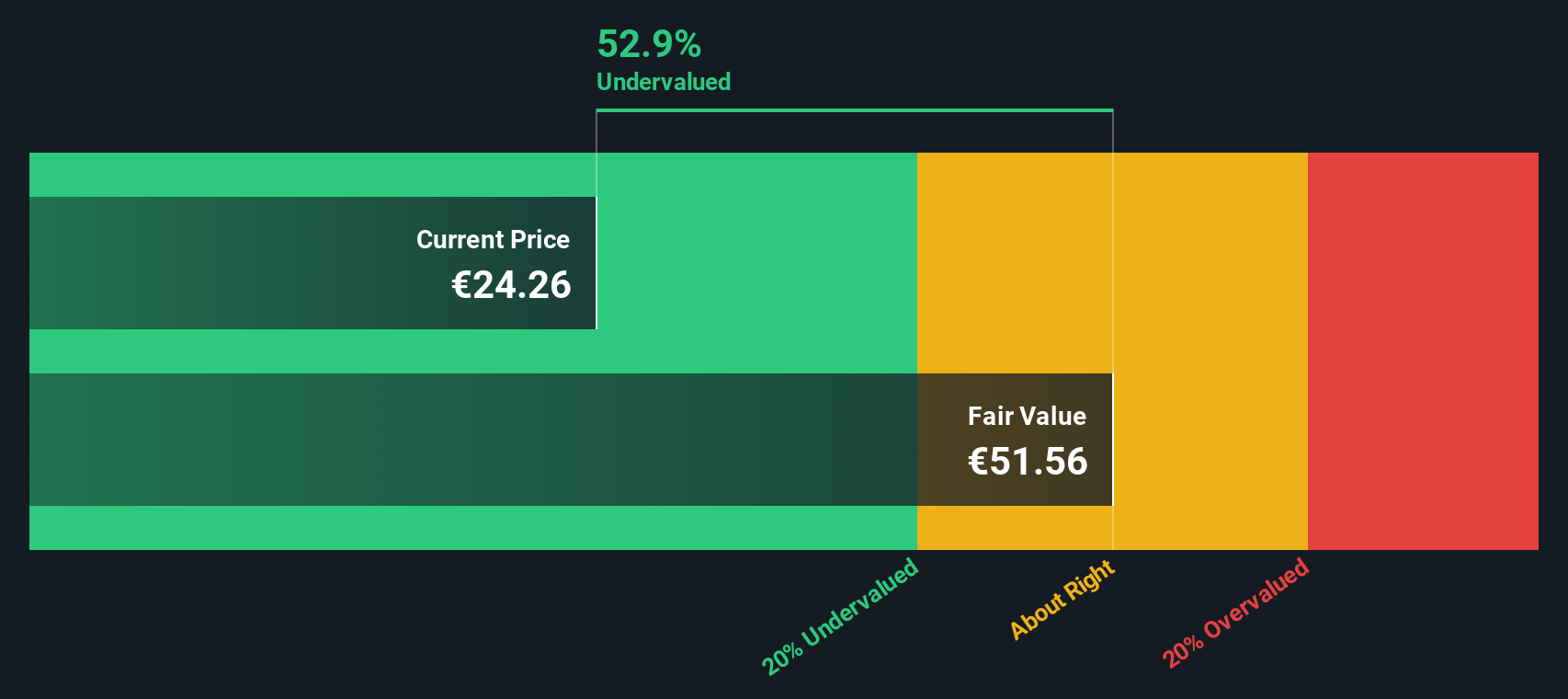

While the price-to-earnings ratio puts Philips in an expensive light compared to peers, our SWS DCF model paints a contrasting picture. The model estimates fair value at €45.12, suggesting the current price is almost 48% below what the company could truly be worth. Could the market be overlooking future cash flows and potential growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Koninklijke Philips for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Koninklijke Philips Narrative

If you want a different perspective or would rather build your own case, you can create a custom narrative for Koninklijke Philips in just a few minutes with Do it your way.

A great starting point for your Koninklijke Philips research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for ordinary returns when standout opportunities are waiting to be seized. Unlock compelling investment ideas selected by advanced screeners, and get ahead before the crowd.

- Capture tomorrow’s software breakthroughs by reviewing these 25 AI penny stocks as they set new standards with innovative artificial intelligence solutions.

- Position yourself for income and stability with these 17 dividend stocks with yields > 3%, focusing on businesses offering robust yields above 3%.

- Tap into technological disruption by scanning these 26 quantum computing stocks, which highlights companies pioneering in next-generation quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Philips might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PHIA

Koninklijke Philips

Operates as a health technology company in North America, the Greater China, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives