- Netherlands

- /

- Food

- /

- ENXTAM:JDEP

JDE Peet's Valuation in Focus as Stock Surges 89% on Global Coffee Push

Reviewed by Bailey Pemberton

- Wondering if JDE Peet's stock is a great deal right now? You are not alone, especially as more investors are eyeing its recent moves.

- This year, the stock has surged an impressive 89%, and it is up 64.7% over the past 12 months, suggesting the market may be rethinking its growth and risk profile.

- Recent headlines have highlighted JDE Peet’s push to expand its global coffee presence and efforts to strengthen its sustainability commitments. Both developments have captured investor interest and likely contributed to the price gains. New strategic partnerships and sustainability initiatives suggest the company is positioning itself for long-term relevance in the competitive beverage space.

- On valuation, JDE Peet’s currently achieves a score of 3 out of 6 across our value checks, raising the question of how much upside remains. Let’s break down a few common ways to value the stock, plus a perspective at the end that could change how you look at valuation entirely.

Approach 1: JDE Peet's Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a business by projecting its future cash flows and discounting them back to today’s euros. This analysis aims to determine what the company is truly worth, accounting for its future growth potential and the time value of money.

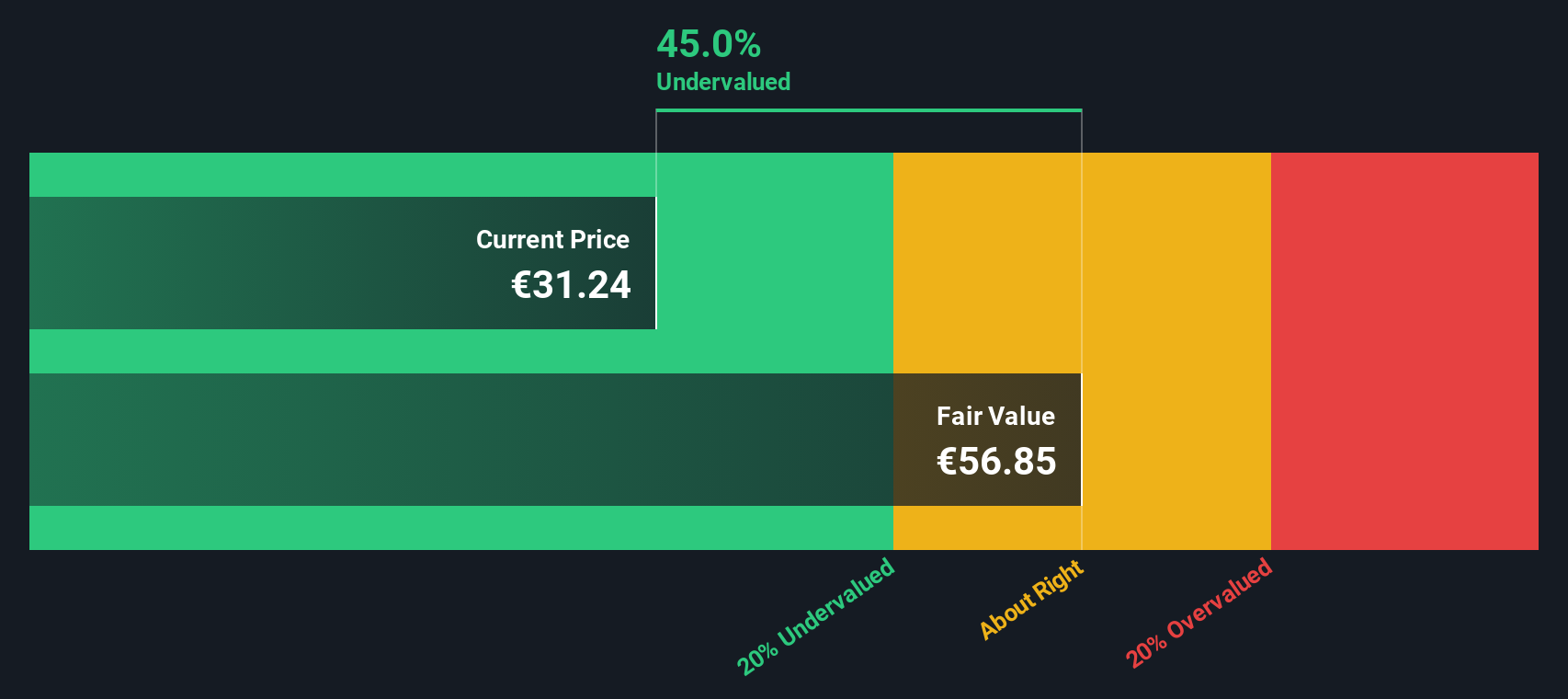

For JDE Peet's, the DCF model uses recent performance and analyst forecasts to extend cash flow estimates over the next decade. The company generated a robust €1.26 billion in free cash flow (FCF) over the last twelve months. Looking ahead, analysts expect annual FCF to increase, reaching approximately €972.5 million by 2028. Beyond those years, further FCF figures are extrapolated based on reasonable growth assumptions.

After discounting future cash flows to their present value, the model suggests JDE Peet’s shares have an intrinsic value of €60.80. This result is 48.1% lower than the current market price, indicating the stock could be significantly undervalued by this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests JDE Peet's is undervalued by 48.1%. Track this in your watchlist or portfolio, or discover 831 more undervalued stocks based on cash flows.

Approach 2: JDE Peet's Price vs Earnings

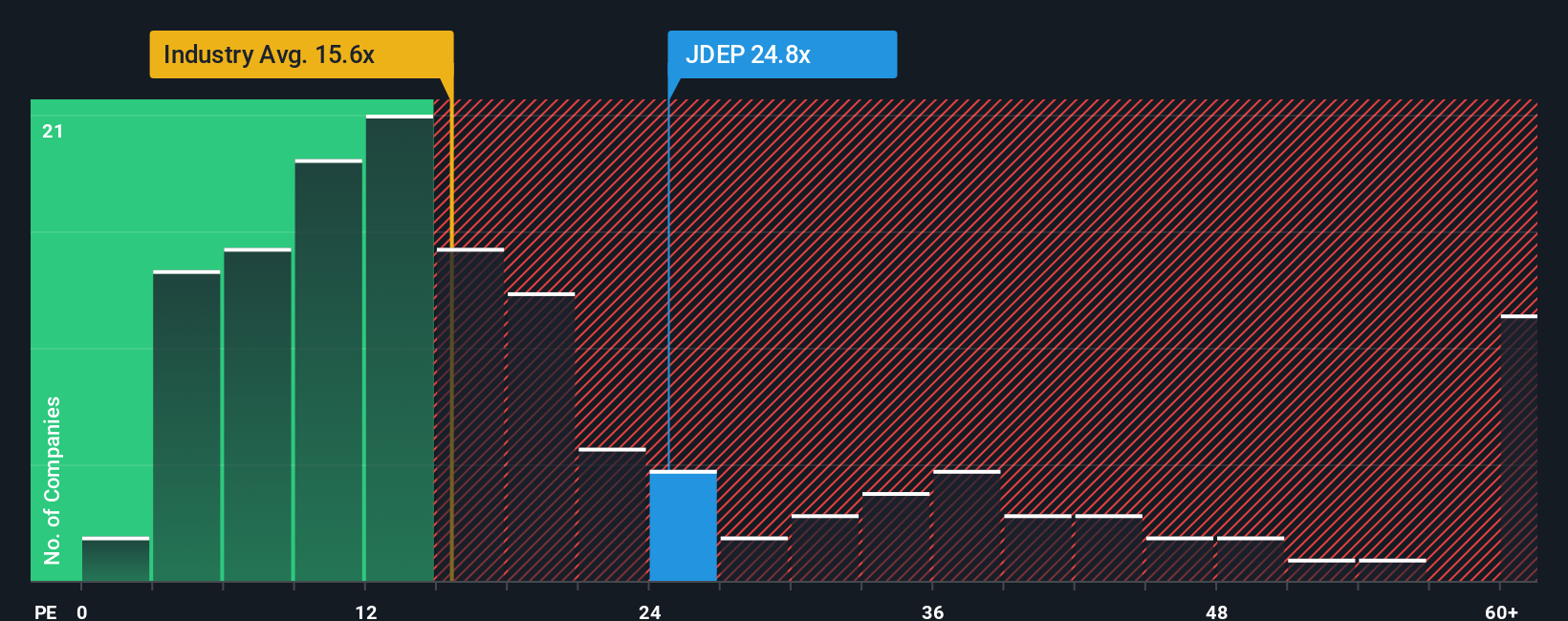

The Price-to-Earnings (PE) ratio is a time-tested way of valuing profitable companies like JDE Peet's. It distills investor expectations about both future growth and the risks facing a business. Typically, a higher PE reflects stronger growth prospects or a lower risk profile, while a lower multiple might flag the opposite.

JDE Peet’s currently trades on a PE ratio of 24.7x. To put that in context, this is notably above the food industry average of 16.2x and just below the peer group average of 31.3x. This highlights a valuation premium compared to its sector but still places it just below the most richly valued competitors.

Simply Wall St’s proprietary "Fair Ratio" for JDE Peet's is 17.8x. This is not just an arbitrary number, but a calculated benchmark that weighs the company’s growth rate, margins, market cap, risk factors, and its position relative to the overall industry. While industry averages and peer comparisons are helpful starting points, the Fair Ratio gives a more tailored perspective that adjusts for JDE Peet’s unique financial profile and business outlook.

Comparing the Fair Ratio of 17.8x with the actual 24.7x PE, JDE Peet’s appears to be overvalued on a relative basis by this metric, even after accounting for growth and profitability.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your JDE Peet's Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Narratives are simply the story you believe about a company, the why and how behind your forecasts, connecting your perspective on future revenue, margins, and fair value directly to the business’s real-world journey.

Instead of just looking at static ratios or models, Narratives let you anchor your investment decisions to a dynamic combination of facts and context. On Simply Wall St's Community page, millions of investors craft their own Narratives by stating their view of JDE Peet’s future, quantifying it with revenue and margin estimates, and seeing the corresponding fair value calculated live. This makes it easy and accessible to map your outlook onto today’s share price, so you know if your narrative suggests JDE Peet’s is a buy, hold, or sell.

Best of all, Narratives are kept up to date when new news, earnings, or events impact the company, so your story and its resulting fair value can adjust automatically. For example, some investors see significant value unlocked by JDE Peet's premiumization and global reach, leading to bullish price targets as high as €31.0, while others worry about risks from acquisition valuations and input costs, estimating targets as low as €20.5. This demonstrates how your narrative shapes your valuation and decisions.

Do you think there's more to the story for JDE Peet's? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:JDEP

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives