- Netherlands

- /

- Beverage

- /

- ENXTAM:HEIA

Heineken (ENXTAM:HEIA): Exploring Valuation Gaps as Shares Show Renewed Momentum

Reviewed by Simply Wall St

Heineken (ENXTAM:HEIA) shares have shown modest movement over the past month, trading at around €68.44. Investors are weighing recent performance alongside the company’s solid annual revenue and net income growth as the outlook for the beverage sector evolves.

See our latest analysis for Heineken.

Heineken’s 1-month share price return of 3.7% hints at improved sentiment as investors look past a tough 12 months, where the total shareholder return is still down 5.2%. Momentum appears to be building again after a muted start to the year, particularly as the broader sector looks for clearer catalysts.

If the steady uptick in Heineken's share price has you thinking about where else opportunity is brewing, discover fast growing stocks with high insider ownership.

But with shares trading well below analyst price targets despite steady gains in recent weeks, the big question remains: is Heineken undervalued compared to its fundamentals, or has the market already accounted for future earnings growth?

Most Popular Narrative: 21% Undervalued

Heineken’s most followed narrative sees fair value sitting noticeably higher than the last close price of €68.44. This suggests a sizable gap from current trading levels. This valuation reflects confidence in the company’s strategic direction and future growth levers, but it also relies on certain specific drivers to materialize.

Investments in digital transformation, including scaling digital backbones, advanced route-to-market models, and data-driven productivity (targeting over €500M in gross savings for 2025), are laying the groundwork for long-term operational leverage and net margin expansion.

Think these numbers are bold? Curious which big shifts in margins and future earnings underpin this projected upside? Dive in to see how ambitious operational targets and aggressive portfolio shifts fuel this narrative’s high fair value.

Result: Fair Value of €86.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing currency volatility and stagnation in mature European markets could quickly challenge these growth forecasts and force a reassessment of Heineken's fair value outlook.

Find out about the key risks to this Heineken narrative.

Another View: What Does the SWS DCF Model Say?

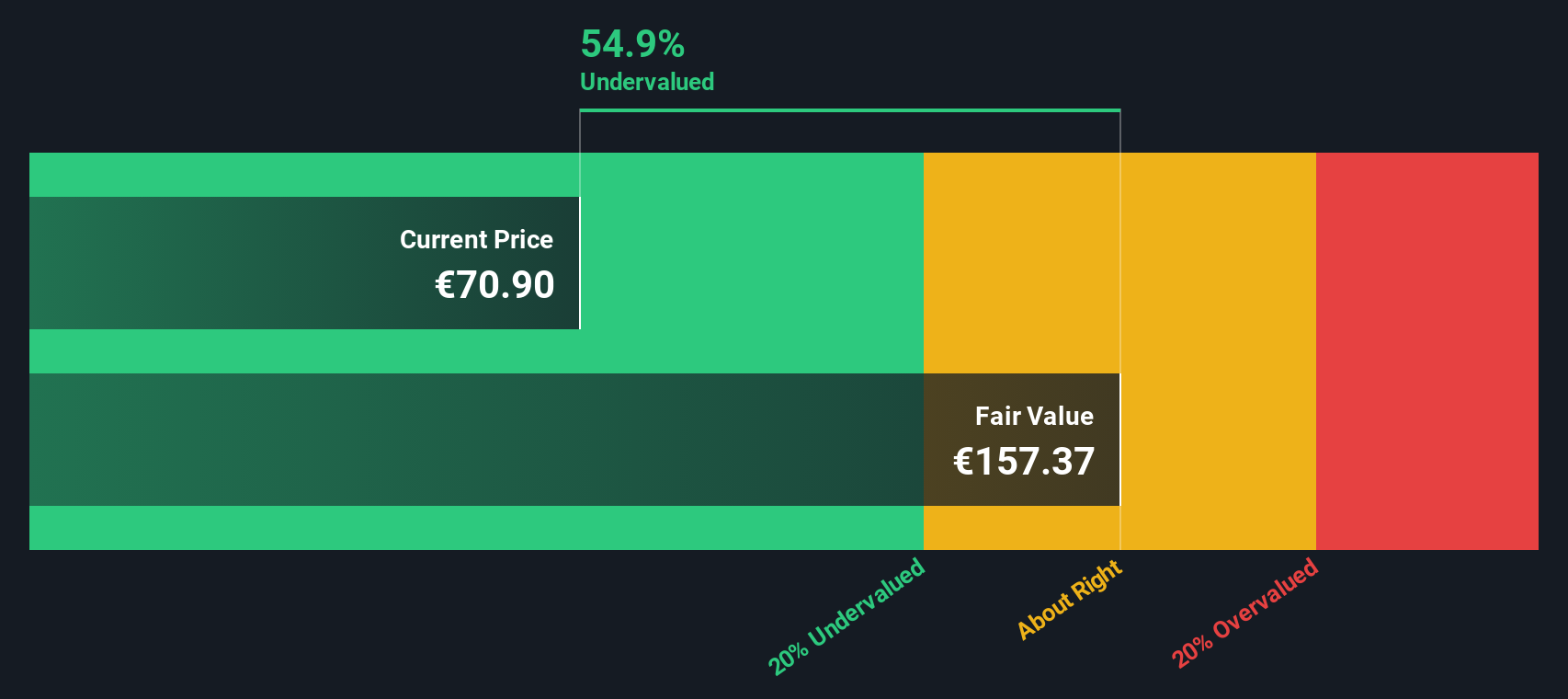

While the market-based valuation approach suggests Heineken could be undervalued, our DCF model estimates a fair value of €155.20, which is far above the latest share price. This method projects stronger upside potential based on long-term cash flows. Could the market be overlooking something big?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Heineken Narrative

If you have your own perspective or prefer hands-on analysis, you can explore the data and craft your own Heineken narrative in just a few minutes by using Do it your way.

A great starting point for your Heineken research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take your investing further with proven opportunities beyond Heineken. These screens reveal standout stocks shaping major trends right now. Don’t watch from the sidelines while others take advantage.

- Capture consistent income streams by checking out these 18 dividend stocks with yields > 3%, which features yields above 3%, and discover which companies reward shareholders the most.

- Tap into the booming field of artificial intelligence by reviewing these 27 AI penny stocks, highlighting companies making headlines for their rapid innovation and growth potential.

- Position yourself ahead of the crowd by scanning these 842 undervalued stocks based on cash flows based on cash flow. This can help you spot value before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heineken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:HEIA

Heineken

Heineken N.V. brews and sells beer and cider in the Americas, Europe, Africa, the Middle East, and the Asia Pacific.

Solid track record average dividend payer.

Market Insights

Community Narratives