- Netherlands

- /

- Diversified Financial

- /

- ENXTAM:EXO

Exor (ENXTAM:EXO): Evaluating Valuation as Recent Share Slide Prompts Investor Scrutiny

Reviewed by Simply Wall St

If you have been keeping a close eye on Exor (ENXTAM:EXO) lately, you might be wondering what to make of its recent share movements. While there has not been a headline-grabbing trigger event, the stock’s downward drift has caught the attention of investors looking for value or signs of a changing narrative. Sometimes, a quiet slide prompts even more questions than a sharp rally or plunge, leading many to reconsider what is actually being priced in.

Over the past year, Exor’s share price has dipped 15%, continuing a negative trend since the start of the year. The slip has persisted through the last month as well, which suggests that momentum is still running against the stock for now. In the broader context, Exor remains up more than 32% over the past three years. Long-term holders have still seen gains despite recent weakness. Other factors, such as net income shrinking over the year, may also be casting a shadow and shaping cautious sentiment among investors.

After this stretch of underperformance, is Exor now undervalued and offering a rare entry point? Or is the market bracing for more challenging days ahead and discounting less growth on the horizon?

Price-to-Earnings of 1.2x: Is it justified?

Exor’s current share price presents a compelling case for undervaluation when analysed through its price-to-earnings (P/E) multiple, coming in at just 1.2x. This is significantly lower than both the average for its peers (22.3x) and the broader European diversified financials sector (14.8x). This suggests the market is pricing in conservative expectations relative to the company’s recent performance and sector standing.

The price-to-earnings ratio is a critical measure of how much investors are willing to pay per euro of earnings. For a holding company like Exor, which reports both operating firms’ results and investment performance, a low P/E may indicate skepticism about earnings quality or growth sustainability, or it may simply signal a mispricing relative to fundamentals.

With Exor trading far below the sector average, the numbers imply the market is discounting future profit growth and possibly placing limited value on recent extraordinary earnings. Whether this discount is justified, given Exor’s accelerating historical profit growth and a seasoned management team, is a key question for value-focused investors considering an entry point.

Result: Fair Value of €412.18 (UNDERVALUED)

See our latest analysis for Exor.However, sustained earnings declines and continued negative momentum in the share price could signal deeper issues that challenge the undervaluation thesis.

Find out about the key risks to this Exor narrative.Another View: A Deeper Dive with Our DCF Model

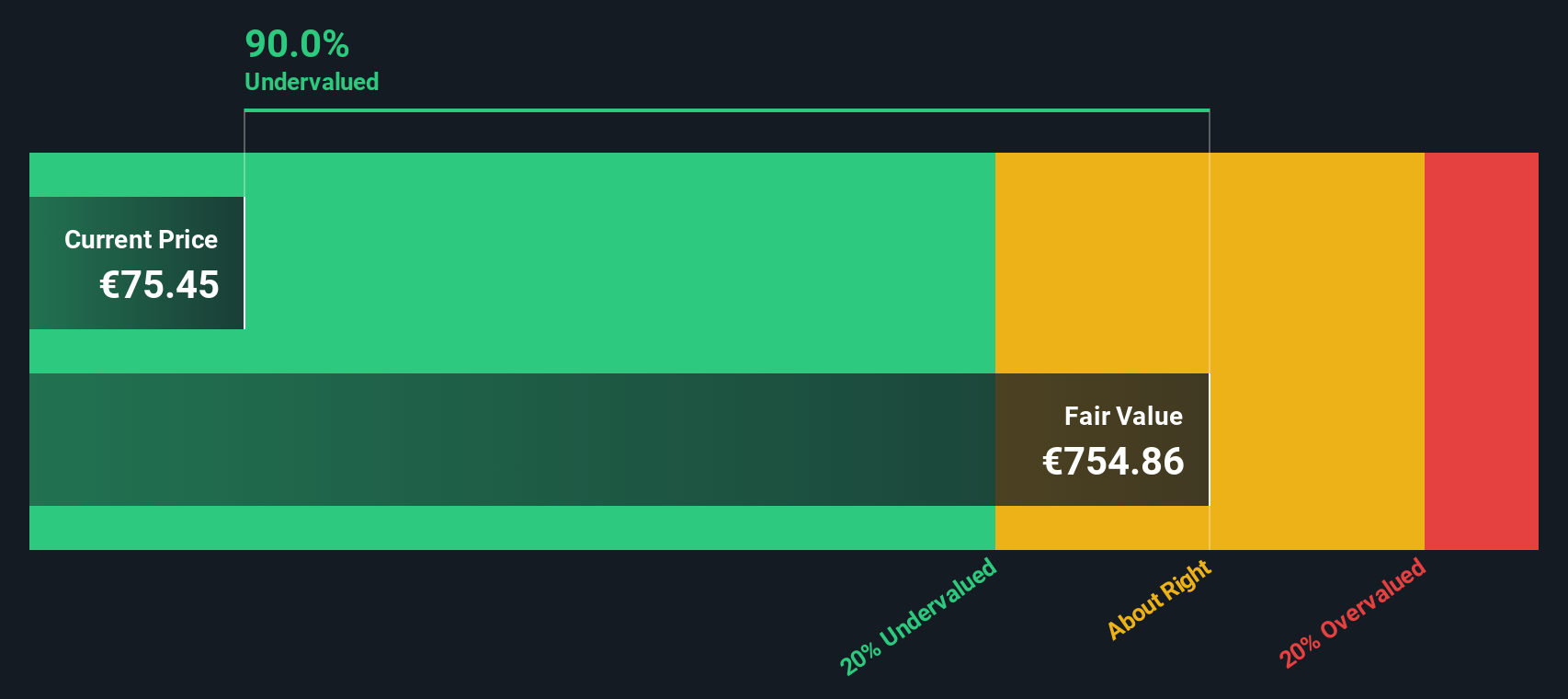

The SWS DCF model offers a different perspective by analyzing Exor’s projected cash flows. This approach also points to shares being undervalued, but can models ever capture every nuance? Especially when the market seems unconvinced.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Exor Narrative

If you see things differently or want to do your own homework, you can put together your own view in just a few minutes. Do it your way

A great starting point for your Exor research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock your next opportunity with investment screens designed to uncover exactly what you are seeking. Stop waiting on the sidelines and get ahead today.

- Target companies the market may have overlooked by scanning for undervalued stocks based on cash flows. Identify these opportunities before they catch everyone else’s attention.

- Accelerate your search for stocks positioned to benefit from the future of medicine. Use healthcare AI stocks to power your review of healthcare innovations.

- Boost your portfolio’s income potential by reviewing dividend stocks with yields > 3%. Explore options delivering attractive, tangible returns year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTAM:EXO

Exor

Engages in the automotive, agriculture and construction, sports car, commercial vehicle, and powertrain businesses worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives