- Netherlands

- /

- Diversified Financial

- /

- ENXTAM:ADYEN

Will Adyen's (ENXTAM:ADYEN) New Terminals Shift Its Competitive Edge in In-Person Payments?

Reviewed by Sasha Jovanovic

- Adyen recently announced the launch of two new payment terminals, the S1E4 Pro and S1F4 Pro, designed for demanding use cases across retail, hospitality, food & beverage, and beauty & wellness, with availability beginning in Europe, the UK, North America, New Zealand, and the UAE in the first quarter of 2026.

- This expansion into advanced in-person payment solutions underscores Adyen's focus on innovation and streamlined merchant operations as it prepares to release a new strategic outlook during its upcoming Investor Day.

- We'll examine how the debut of these rugged payment terminals could influence Adyen's growth story and competitive positioning.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Adyen Investment Narrative Recap

To own Adyen, investors need confidence in the company's ability to capture more enterprise merchant volume and deliver sustained innovation within payments technology. The launch of the S1E4 Pro and S1F4 Pro terminals brings incremental product strength, but does not dramatically shift the main near-term catalyst, which remains continued share of wallet expansion among existing and new large enterprise customers. The key risk is still execution: slower gains in merchant penetration or competitive pricing pressures could dampen top-line progress, and this news alone does not reduce those concerns.

Against this backdrop, Adyen's reaffirmed revenue guidance for 2025 and its target for low-20s to mid-20s net revenue growth in 2026 is particularly relevant. While new hardware supports the company's omnichannel ambitions, most eyes will remain fixed on whether payment volumes and client wins deliver on these updated growth expectations.

But even the most impressive new product lineup won't insulate Adyen if competitive margin pressures begin to outweigh volume gains and investors should be aware of...

Read the full narrative on Adyen (it's free!)

Adyen's narrative projects €3.9 billion in revenue and €1.8 billion in earnings by 2028. This requires 21.3% yearly revenue growth and an increase of about €800 million in earnings from the current €996.5 million.

Uncover how Adyen's forecasts yield a €1813 fair value, a 36% upside to its current price.

Exploring Other Perspectives

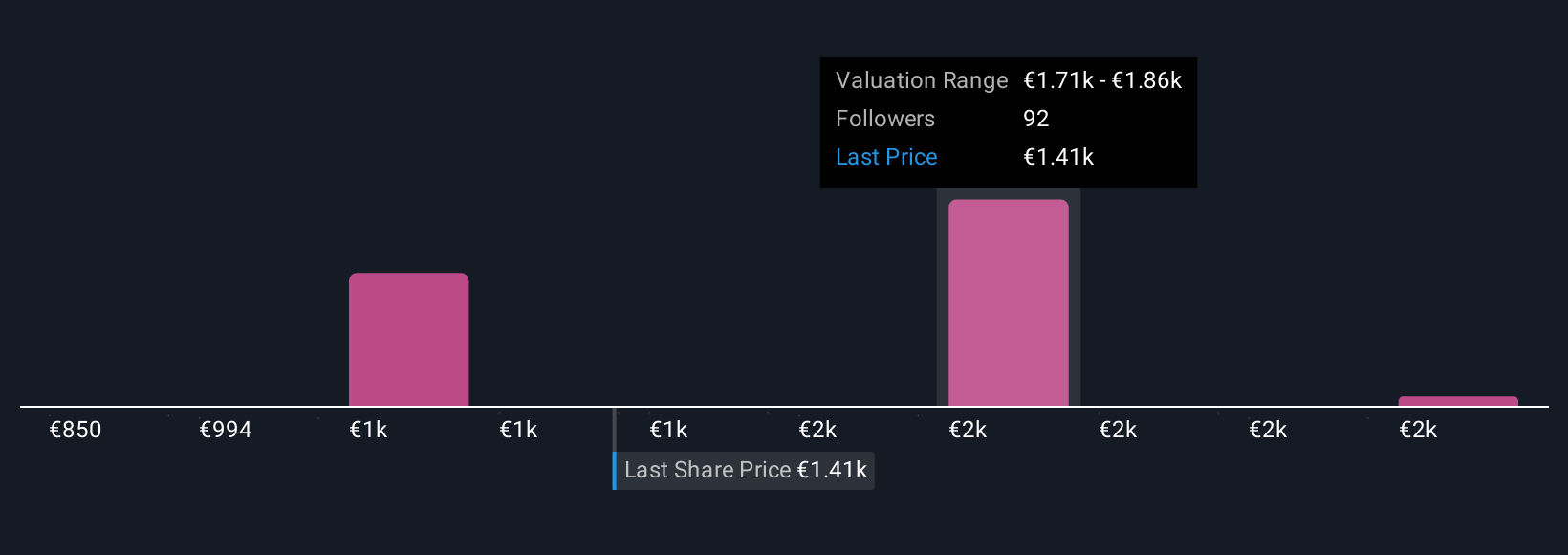

Sixteen members of the Simply Wall St Community see fair value for Adyen shares from €850 up to €2,286. Some are focused on innovation delivering margin growth, but broad competition could test those expectations. Consider several viewpoints as you assess your outlook.

Explore 16 other fair value estimates on Adyen - why the stock might be worth 36% less than the current price!

Build Your Own Adyen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adyen research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Adyen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adyen's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ADYEN

Adyen

Operates a payments platform in Europe, the Middle East, Africa, North America, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives