- Netherlands

- /

- Food and Staples Retail

- /

- ENXTAM:AD

Assessing Ahold Delhaize (ENXTAM:AD): Is the Grocer Quietly Undervalued?

Reviewed by Simply Wall St

Most Popular Narrative: 3.6% Undervalued

The current consensus among analysts is that Koninklijke Ahold Delhaize is modestly undervalued, with a fair value that sits slightly above the current share price. While the stock has not captured headlines, the prevailing narrative points to latent opportunity based on future performance assumptions.

Operational efficiency gains through automation, supply chain optimization, and cost discipline enable reinvestment in growth and margin resilience. This occurs even amid price investments and inflationary pressures, supporting favorable longer-term earnings and margin profiles.

Curious what is fueling this valuation call? There is a key financial lever at the center of these price targets, built on an ambitious vision for future growth and profit margins. Want to see the precise benchmarks analysts believe Ahold Delhaize will clear to close the gap between its market price and true value? Find out the strategic forecasts that could make this stock one of the sector’s quiet outperformers.

Result: Fair Value of €35.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, continued margin pressure in the U.S. from competitive pricing and a growing share of lower-margin online sales could challenge the optimistic outlook.

Find out about the key risks to this Koninklijke Ahold Delhaize narrative.Another View: Discounted Cash Flow Perspective

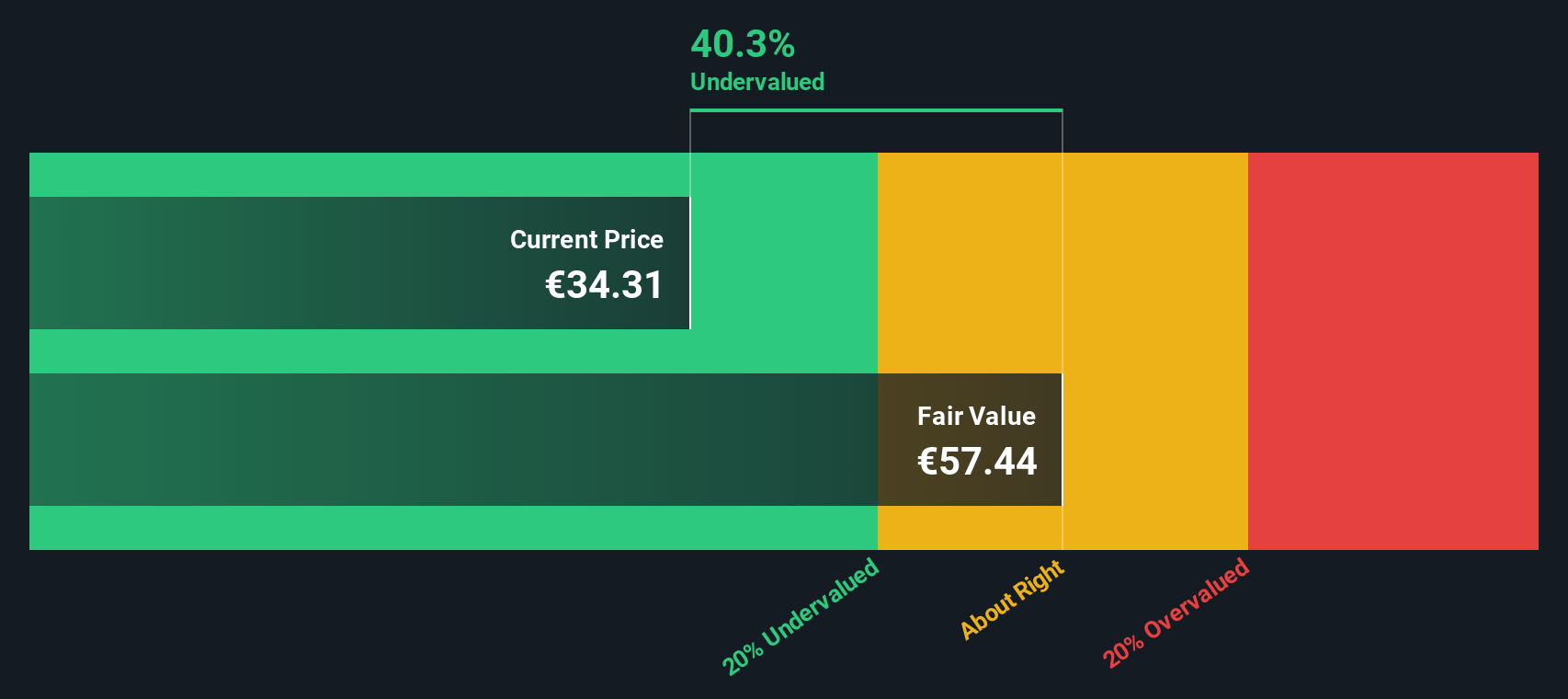

Looking through the lens of our DCF model, the picture shifts. This method suggests Koninklijke Ahold Delhaize could offer more value than what market prices currently suggest. Does this deeper valuation tell the whole story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Koninklijke Ahold Delhaize Narrative

Keep in mind that your own perspective might reveal additional insights. You can assemble a personal narrative in just a few minutes. Do it your way

A great starting point for your Koninklijke Ahold Delhaize research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself an edge by seeking out stocks worth your attention. Bold opportunities are often one click away. Don’t sit on the sidelines and miss unique investment trends, especially when new winners emerge daily.

- Boost your portfolio by targeting companies offering reliable payouts and see which top performers are paying dividend stocks with yields > 3% right now.

- Tap into next-generation tech breakthroughs and find potential growth leaders among AI penny stocks fueling tomorrow’s innovations.

- Unearth hidden gems trading below their true worth by getting an inside look at undervalued stocks based on cash flows others might be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Ahold Delhaize might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTAM:AD

Koninklijke Ahold Delhaize

Operates retail food stores and e-commerce in the Netherlands, the United States, and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives