- Netherlands

- /

- Electrical

- /

- ENXTAM:ALFEN

Alfen's (AMS:ALFEN) five-year earnings growth trails the strong shareholder returns

It hasn't been the best quarter for Alfen N.V. (AMS:ALFEN) shareholders, since the share price has fallen 11% in that time. But in stark contrast, the returns over the last half decade have impressed. It's fair to say most would be happy with 253% the gain in that time. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Only time will tell if there is still too much optimism currently reflected in the share price. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 51% decline over the last twelve months.

Since the stock has added €70m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Alfen

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

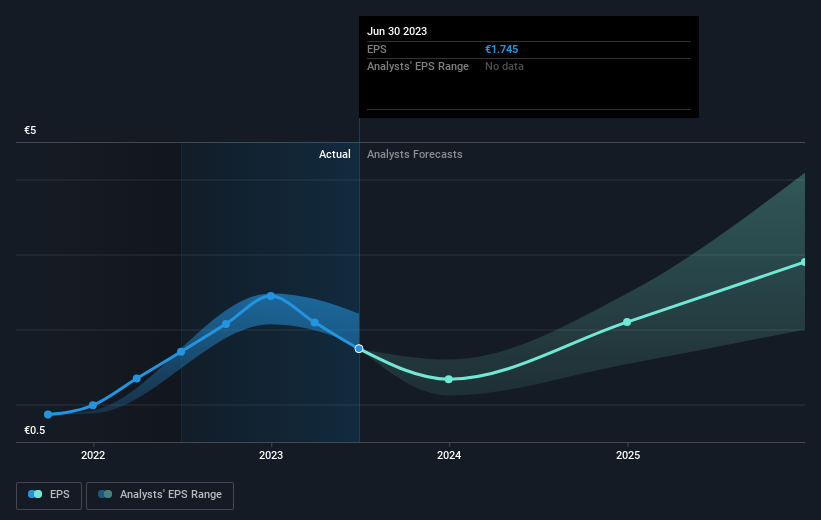

During five years of share price growth, Alfen achieved compound earnings per share (EPS) growth of 84% per year. The EPS growth is more impressive than the yearly share price gain of 29% over the same period. So it seems the market isn't so enthusiastic about the stock these days.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Alfen has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Alfen stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in Alfen had a tough year, with a total loss of 51%, against a market gain of about 5.3%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 29% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Alfen better, we need to consider many other factors. For example, we've discovered 3 warning signs for Alfen that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Dutch exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:ALFEN

Alfen

Through its subsidiaries, engages in the design, engineering, development, production, and service of smart grids, energy storage systems, and electric vehicle charging equipment.

Flawless balance sheet with moderate growth potential.