- Norway

- /

- Construction

- /

- OB:NORCO

Discover These 3 Undiscovered Gems in Europe

Reviewed by Simply Wall St

Amidst a backdrop of political instability and tariff uncertainties, the European market has faced challenges, with key indices like the STOXX Europe 600 Index experiencing declines. However, these conditions can often present opportunities for investors to explore undervalued or overlooked stocks that may offer potential growth as market dynamics evolve.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 3.60% | 33.84% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Dekpol | 63.20% | 11.99% | 14.08% | ★★★★★☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

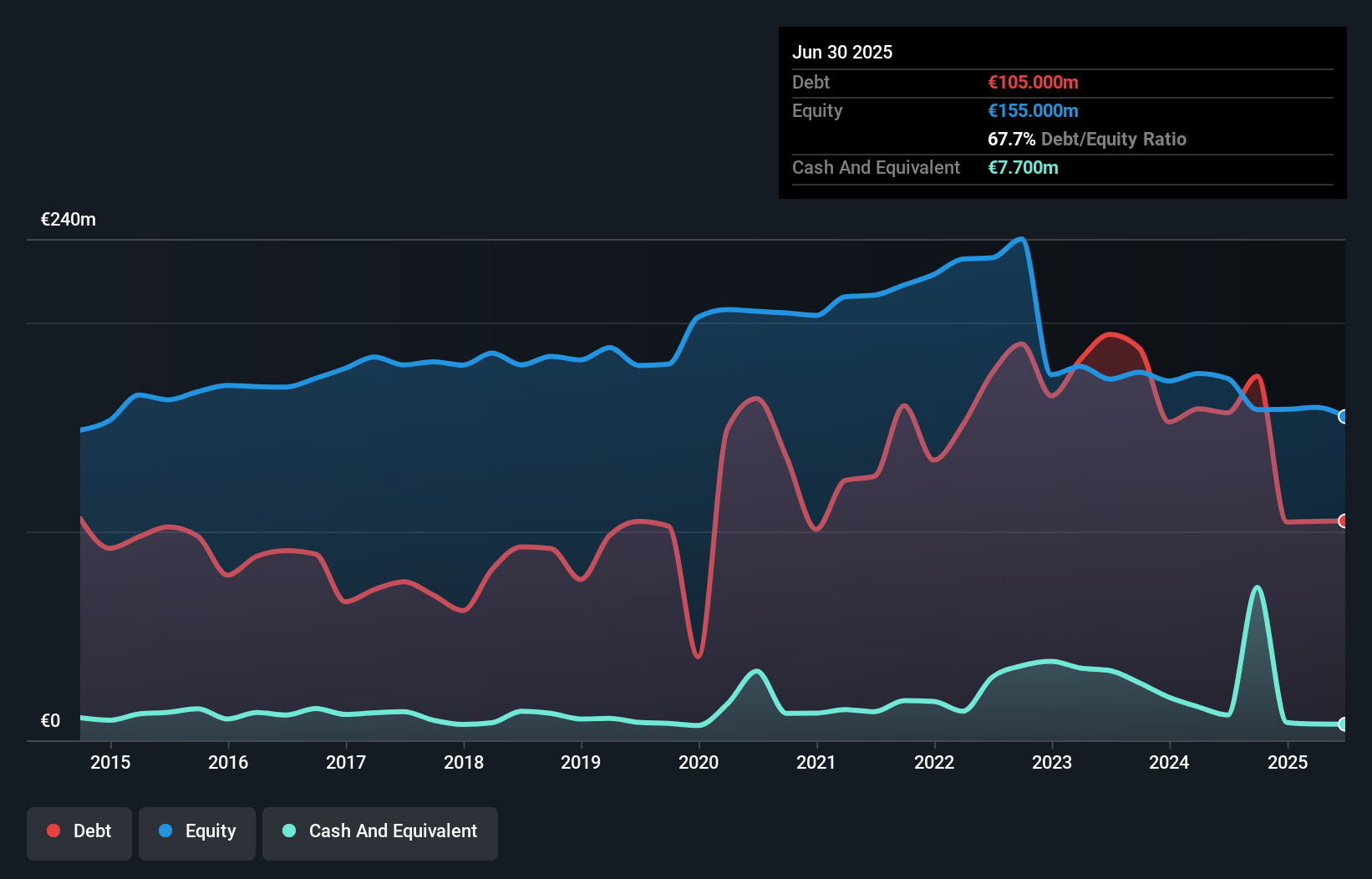

Kendrion (ENXTAM:KENDR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kendrion N.V. is a company that specializes in the development, manufacturing, and sale of actuators and control systems across various global markets, with a market capitalization of approximately €215.30 million.

Operations: Kendrion generates revenue primarily from its Industrial segment, contributing €236.80 million, and additional income from Other Business at €69.40 million.

Kendrion, a standout in the auto components sector, has been making waves with its strong earnings growth of 19.7% over the past year, outpacing the industry average. Despite a high net debt to equity ratio of 62.8%, its interest payments are well covered by EBIT at 3.5x coverage, indicating financial resilience. The company is trading at a significant discount of 66.3% below its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. Recent results show impressive performance with net income rising to €4.4 million from €1.5 million last year and basic EPS jumping to €0.28 from €0.10.

- Navigate through the intricacies of Kendrion with our comprehensive health report here.

Explore historical data to track Kendrion's performance over time in our Past section.

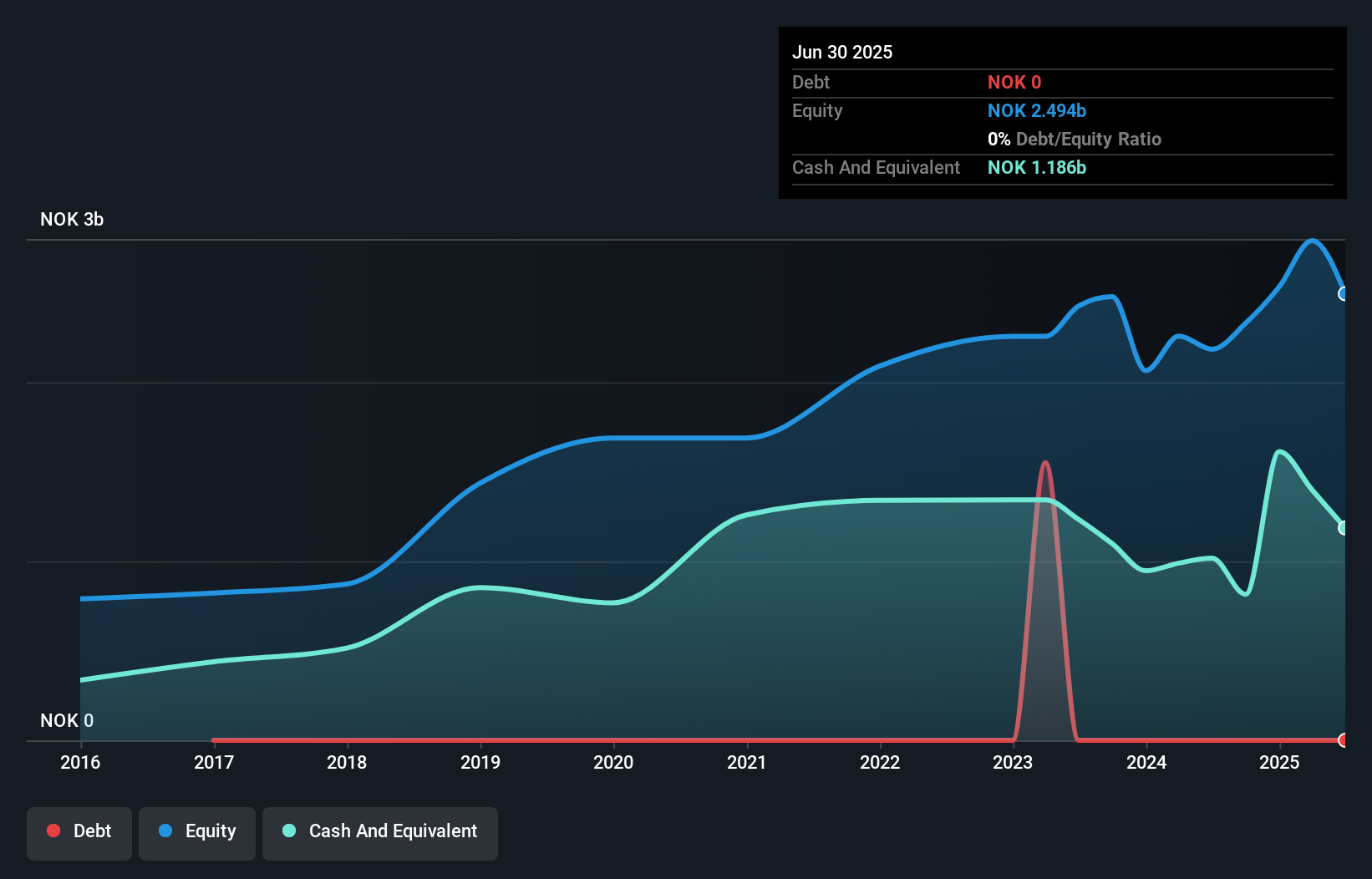

Norconsult (OB:NORCO)

Simply Wall St Value Rating: ★★★★★★

Overview: Norconsult ASA is a consultancy firm offering services in community planning, engineering design, and architecture across the Nordics and internationally, with a market capitalization of NOK 14.30 billion.

Operations: The consultancy firm's primary revenue streams are from the Norway Head Office (NOK 3.14 billion) and Norway Regions (NOK 2.95 billion), followed by Sweden (NOK 1.99 billion). The Digital and Techno-Garden segment contributes NOK 1.13 billion, while Renewable Energy adds NOK 948 million. Denmark generates NOK 897 million in revenue, highlighting diverse geographic operations within the Nordics.

Norconsult, a notable player in the Nordic infrastructure and renewables sector, is poised for growth with its significant NOK 7.1 billion order backlog. This backlog is fueled by modernization efforts and renewable energy demand. Despite challenges like reliance on Nordic markets and rising costs, Norconsult's strategic acquisitions, such as Aas-Jakobsen, are likely to enhance profitability through synergies. The company's earnings grew by 57.6% last year compared to the construction industry's -0.9%. Recently reported sales for Q2 were NOK 2,783 million with net income at NOK 113 million; however, net income saw a decrease from NOK 139 million previously.

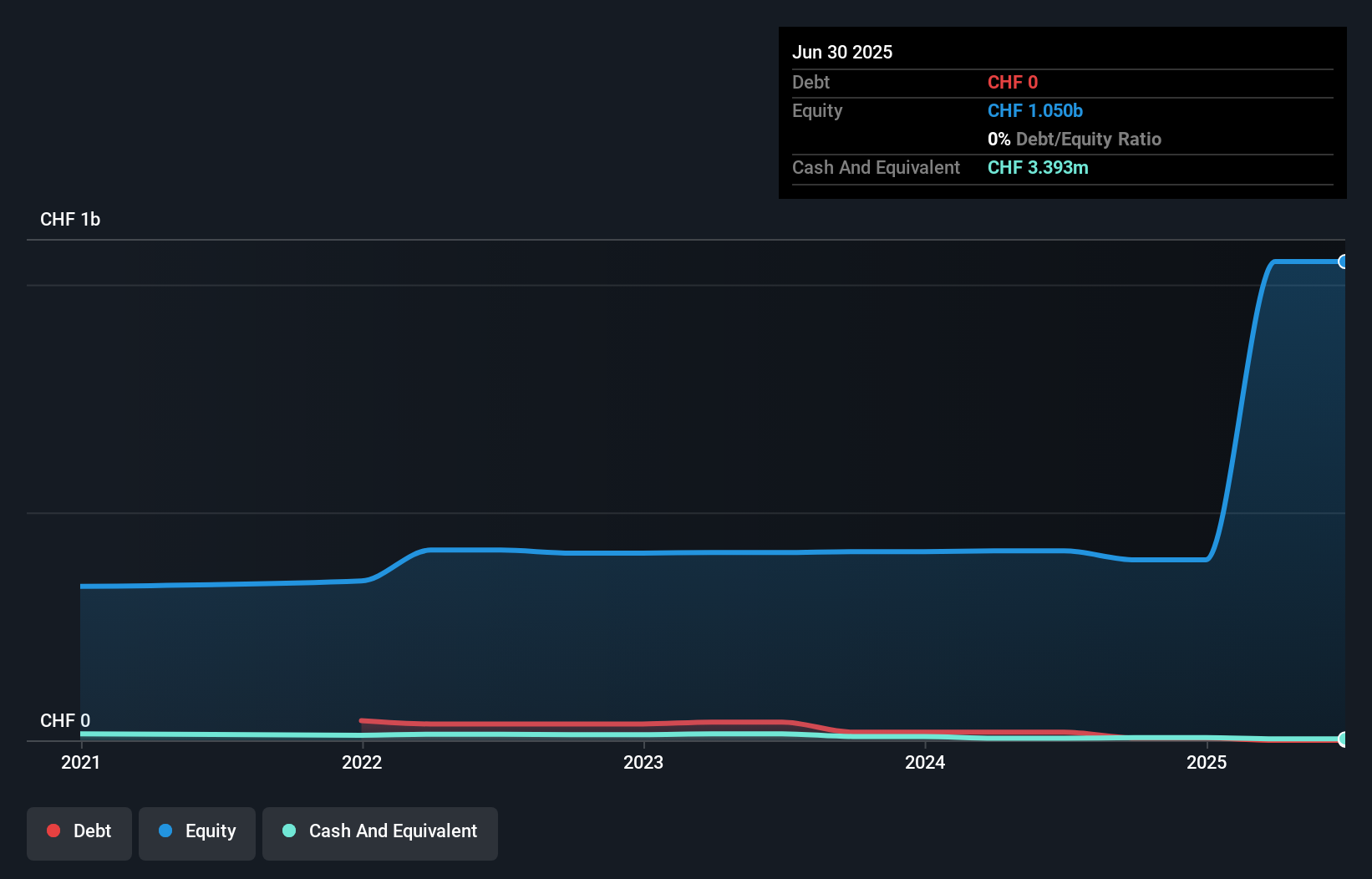

Cham Swiss Properties (SWX:CHAM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cham Swiss Properties AG, with a market cap of CHF1.10 billion, operates as a real estate company in Switzerland through its subsidiaries.

Operations: Cham Swiss Properties generates revenue primarily from its real estate operations in Switzerland. The company's net profit margin is 28.5%, reflecting its efficiency in converting revenue into actual profit.

Cham Swiss Properties, a smaller player in the real estate sector, showcases robust financial health with high-quality earnings and no debt. Recently turning profitable, it reported a net income of CHF 144 million for H1 2025, alongside sales of CHF 9.14 million. Despite substantial shareholder dilution over the past year, its price-to-earnings ratio stands attractively at 8.7x compared to the Swiss market average of 19.9x. While revenue is projected to grow by approximately 7% annually, earnings are expected to decrease by an average of nearly 14% per year over the next three years, presenting a mixed outlook for potential investors.

Turning Ideas Into Actions

- Embark on your investment journey to our 328 European Undiscovered Gems With Strong Fundamentals selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norconsult might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NORCO

Norconsult

Provides consultancy services with focus on community planning, engineering design, and architecture in the Nordics and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives