- Malaysia

- /

- Other Utilities

- /

- KLSE:YTLPOWR

Improved Earnings Required Before YTL Power International Berhad (KLSE:YTLPOWR) Shares Find Their Feet

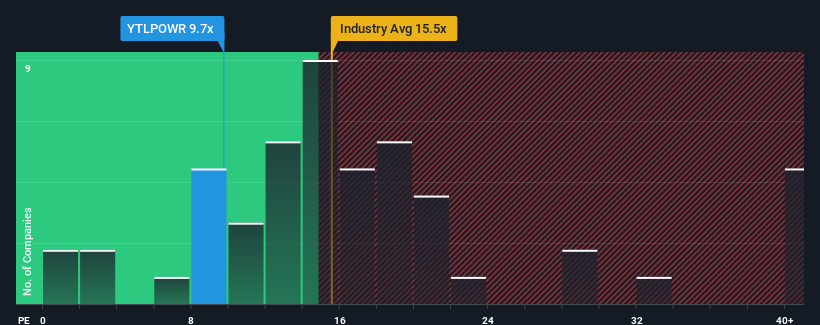

With a price-to-earnings (or "P/E") ratio of 9.7x YTL Power International Berhad (KLSE:YTLPOWR) may be sending bullish signals at the moment, given that almost half of all companies in Malaysia have P/E ratios greater than 17x and even P/E's higher than 30x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, YTL Power International Berhad has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for YTL Power International Berhad

Is There Any Growth For YTL Power International Berhad?

There's an inherent assumption that a company should underperform the market for P/E ratios like YTL Power International Berhad's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 87%. The latest three year period has also seen an excellent 1,879% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings growth is heading into negative territory, declining 8.1% each year over the next three years. With the market predicted to deliver 12% growth per year, that's a disappointing outcome.

With this information, we are not surprised that YTL Power International Berhad is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of YTL Power International Berhad's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for YTL Power International Berhad that you need to be mindful of.

If these risks are making you reconsider your opinion on YTL Power International Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:YTLPOWR

YTL Power International Berhad

An investment holding company, provides electricity, clean water, sewerage system, and telecommunication services in Malaysia, Singapore, the United Kingdom, and internationally.

Very undervalued with questionable track record.

Market Insights

Community Narratives