- Malaysia

- /

- Water Utilities

- /

- KLSE:RANHILL

If You Had Bought Ranhill Utilities Berhad's (KLSE:RANHILL) Shares A Year Ago You Would Be Down 33%

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. For example, the Ranhill Utilities Berhad (KLSE:RANHILL) share price is down 33% in the last year. That falls noticeably short of the market decline of around 0.8%. On the bright side, the stock is actually up 28% in the last three years. It's down 2.8% in the last seven days.

Check out our latest analysis for Ranhill Utilities Berhad

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate twelve months during which the Ranhill Utilities Berhad share price fell, it actually saw its earnings per share (EPS) improve by 48%. It could be that the share price was previously over-hyped.

It's surprising to see the share price fall so much, despite the improved EPS. But we might find some different metrics explain the share price movements better.

Ranhill Utilities Berhad's dividend seems healthy to us, so we doubt that the yield is a concern for the market. In fact, it seems more likely that the revenue fall of 6.7% in the last year is the worry. So it seems likely that the weak revenue is making the market more cautious about the stock.

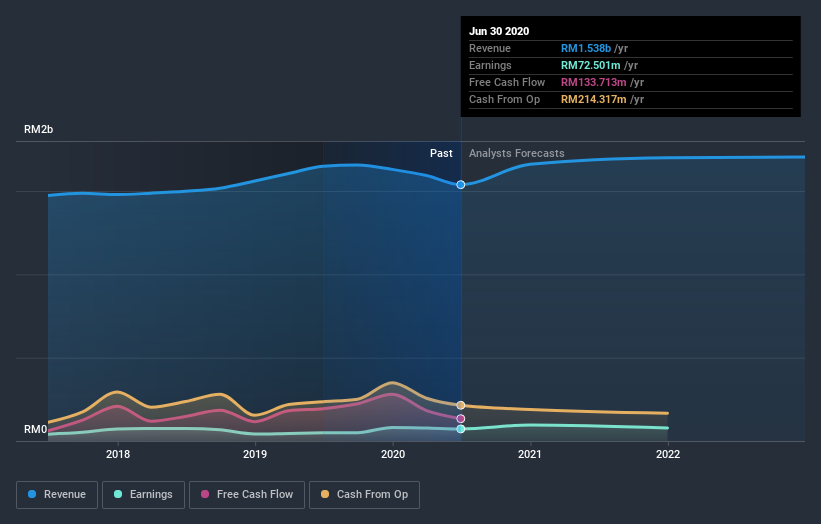

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Ranhill Utilities Berhad has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

What about the Total Shareholder Return (TSR)?

We've already covered Ranhill Utilities Berhad's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Ranhill Utilities Berhad's TSR, which was a 31% drop over the last year, was not as bad as the share price return.

A Different Perspective

Over the last year, Ranhill Utilities Berhad shareholders took a loss of 31%, including dividends. In contrast the market gained about 0.8%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Fortunately the longer term story is brighter, with total returns averaging about 15% per year over three years. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Ranhill Utilities Berhad has 2 warning signs we think you should be aware of.

We will like Ranhill Utilities Berhad better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you’re looking to trade Ranhill Utilities Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:RANHILL

Ranhill Utilities Berhad

An investment holding company, operates in the environment and energy sectors in Malaysia, Thailand, Qatar, Australia, Bangladesh, Brunei, Indonesia, Abu Dhabi, Vietnam, Brazil, and internationally.

Slightly overvalued with questionable track record.