- Malaysia

- /

- Transportation

- /

- KLSE:PTRANS

Here's What To Make Of Perak Transit Berhad's (KLSE:PTRANS) Decelerating Rates Of Return

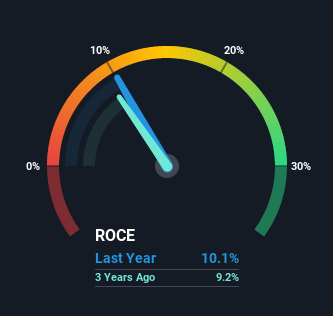

To find a multi-bagger stock, what are the underlying trends we should look for in a business? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. With that in mind, the ROCE of Perak Transit Berhad (KLSE:PTRANS) looks decent, right now, so lets see what the trend of returns can tell us.

What is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Perak Transit Berhad, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.10 = RM68m ÷ (RM736m - RM61m) (Based on the trailing twelve months to March 2021).

Therefore, Perak Transit Berhad has an ROCE of 10%. In absolute terms, that's a satisfactory return, but compared to the Transportation industry average of 6.1% it's much better.

See our latest analysis for Perak Transit Berhad

Above you can see how the current ROCE for Perak Transit Berhad compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Perak Transit Berhad here for free.

How Are Returns Trending?

The trend of ROCE doesn't stand out much, but returns on a whole are decent. The company has consistently earned 10% for the last five years, and the capital employed within the business has risen 167% in that time. Since 10% is a moderate ROCE though, it's good to see a business can continue to reinvest at these decent rates of return. Stable returns in this ballpark can be unexciting, but if they can be maintained over the long run, they often provide nice rewards to shareholders.

The Key Takeaway

In the end, Perak Transit Berhad has proven its ability to adequately reinvest capital at good rates of return. However, despite the favorable fundamentals, the stock has fallen 18% over the last three years, so there might be an opportunity here for astute investors. That's why we think it'd be worthwhile to look further into this stock given the fundamentals are appealing.

If you want to continue researching Perak Transit Berhad, you might be interested to know about the 4 warning signs that our analysis has discovered.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:PTRANS

Perak Transit Berhad

An investment holding company, develops, owns, and operates an integrated public transportation terminal (IPTT) in Malaysia.

Undervalued with slight risk.

Market Insights

Community Narratives