Is Pos Malaysia Berhad (KLSE:POS) Using Debt In A Risky Way?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Pos Malaysia Berhad (KLSE:POS) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Pos Malaysia Berhad

What Is Pos Malaysia Berhad's Net Debt?

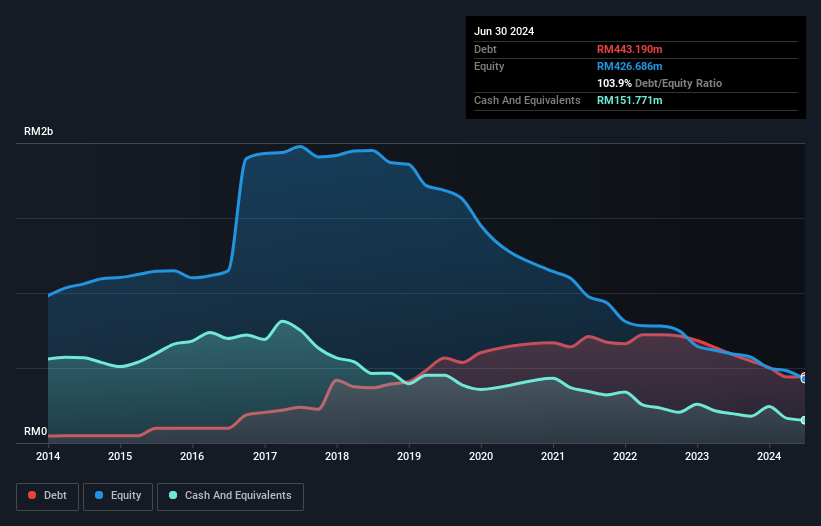

As you can see below, Pos Malaysia Berhad had RM443.2m of debt at June 2024, down from RM589.6m a year prior. However, it does have RM151.8m in cash offsetting this, leading to net debt of about RM291.4m.

How Healthy Is Pos Malaysia Berhad's Balance Sheet?

According to the last reported balance sheet, Pos Malaysia Berhad had liabilities of RM1.45b due within 12 months, and liabilities of RM253.0m due beyond 12 months. Offsetting this, it had RM151.8m in cash and RM802.5m in receivables that were due within 12 months. So its liabilities total RM748.7m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the RM215.3m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Pos Malaysia Berhad would likely require a major re-capitalisation if it had to pay its creditors today. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Pos Malaysia Berhad's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Pos Malaysia Berhad had a loss before interest and tax, and actually shrunk its revenue by 2.5%, to RM1.9b. We would much prefer see growth.

Caveat Emptor

Over the last twelve months Pos Malaysia Berhad produced an earnings before interest and tax (EBIT) loss. Its EBIT loss was a whopping RM120m. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. That said, it is possible that the company will turn its fortunes around. But we think that is unlikely since it is low on liquid assets, and made a loss of RM179m in the last year. So while it's not wise to assume the company will fail, we do think it's risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 2 warning signs for Pos Malaysia Berhad that you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:POS

Pos Malaysia Berhad

Provides postal and parcel services in Malaysia and internationally.

Slight risk and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success