We Think Vortex Consolidated Berhad (KLSE:VC) Can Stay On Top Of Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Vortex Consolidated Berhad (KLSE:VC) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Vortex Consolidated Berhad

How Much Debt Does Vortex Consolidated Berhad Carry?

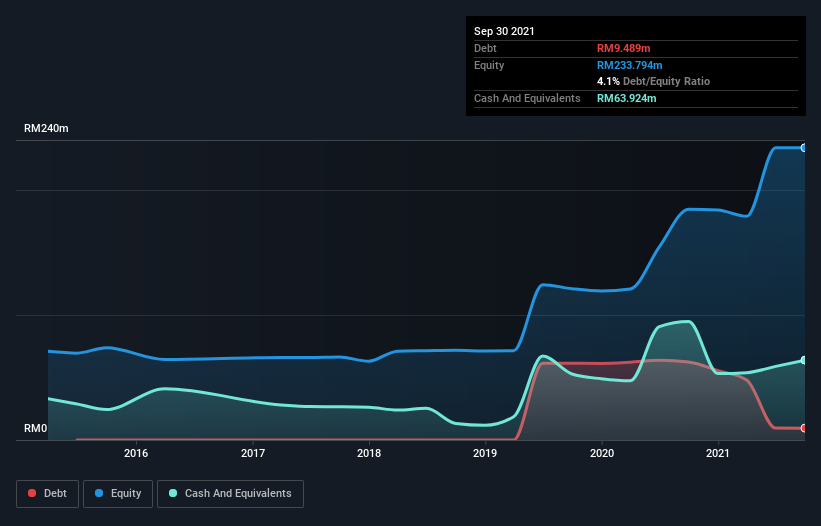

The image below, which you can click on for greater detail, shows that Vortex Consolidated Berhad had debt of RM9.49m at the end of September 2021, a reduction from RM62.4m over a year. But it also has RM63.9m in cash to offset that, meaning it has RM54.4m net cash.

How Healthy Is Vortex Consolidated Berhad's Balance Sheet?

The latest balance sheet data shows that Vortex Consolidated Berhad had liabilities of RM93.8m due within a year, and liabilities of RM7.43m falling due after that. On the other hand, it had cash of RM63.9m and RM72.2m worth of receivables due within a year. So it can boast RM34.9m more liquid assets than total liabilities.

This excess liquidity is a great indication that Vortex Consolidated Berhad's balance sheet is almost as strong as Fort Knox. On this view, lenders should feel as safe as the beloved of a black-belt karate master. Succinctly put, Vortex Consolidated Berhad boasts net cash, so it's fair to say it does not have a heavy debt load!

Notably, Vortex Consolidated Berhad made a loss at the EBIT level, last year, but improved that to positive EBIT of RM2.9m in the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Vortex Consolidated Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Vortex Consolidated Berhad may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last year, Vortex Consolidated Berhad burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing up

While it is always sensible to investigate a company's debt, in this case Vortex Consolidated Berhad has RM54.4m in net cash and a decent-looking balance sheet. So we don't have any problem with Vortex Consolidated Berhad's use of debt. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example Vortex Consolidated Berhad has 3 warning signs (and 2 which shouldn't be ignored) we think you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Harvest Miracle Capital Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HM

Harvest Miracle Capital Berhad

An investment holding company, engages in the trading of information technology (IT) and information communication technology (ICT) related products and services in Malaysia, Japan, the United Kingdom, Singapore, Australia, Philippines, and Taiwan.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives