Microlink Solutions Berhad (KLSE:MICROLN) Surges 28% Yet Its Low P/S Is No Reason For Excitement

Microlink Solutions Berhad (KLSE:MICROLN) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 57% share price drop in the last twelve months.

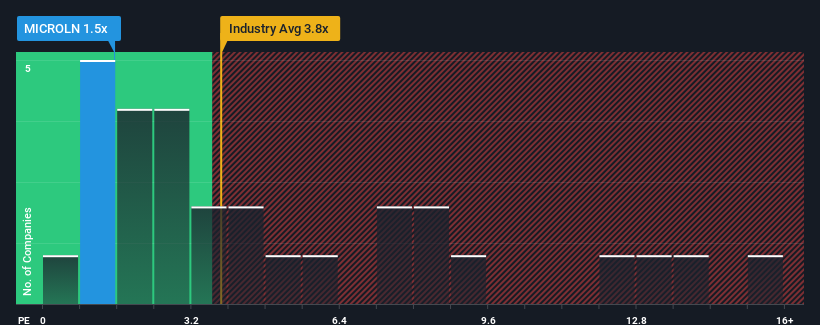

In spite of the firm bounce in price, Microlink Solutions Berhad may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.5x, considering almost half of all companies in the Software industry in Malaysia have P/S ratios greater than 3.8x and even P/S higher than 8x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Microlink Solutions Berhad

How Microlink Solutions Berhad Has Been Performing

Revenue has risen firmly for Microlink Solutions Berhad recently, which is pleasing to see. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Microlink Solutions Berhad will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Microlink Solutions Berhad, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Microlink Solutions Berhad?

In order to justify its P/S ratio, Microlink Solutions Berhad would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. Revenue has also lifted 29% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 25% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's understandable that Microlink Solutions Berhad's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

What Does Microlink Solutions Berhad's P/S Mean For Investors?

Microlink Solutions Berhad's recent share price jump still sees fails to bring its P/S alongside the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Microlink Solutions Berhad confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Microlink Solutions Berhad (1 makes us a bit uncomfortable!) that you need to be mindful of.

If you're unsure about the strength of Microlink Solutions Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MICROLN

Microlink Solutions Berhad

An investment holding company, researches and develops information technology solutions to the financial services industry in Malaysia and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives