Is Digistar Corporation Berhad (KLSE:DIGISTA) A Risky Investment?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Digistar Corporation Berhad (KLSE:DIGISTA) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Digistar Corporation Berhad

What Is Digistar Corporation Berhad's Net Debt?

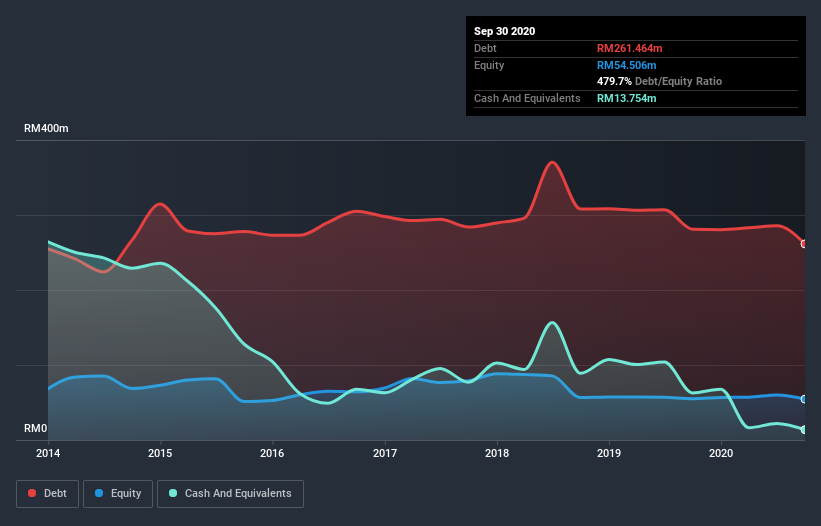

The image below, which you can click on for greater detail, shows that Digistar Corporation Berhad had debt of RM261.5m at the end of September 2020, a reduction from RM281.0m over a year. However, because it has a cash reserve of RM13.8m, its net debt is less, at about RM247.7m.

How Healthy Is Digistar Corporation Berhad's Balance Sheet?

The latest balance sheet data shows that Digistar Corporation Berhad had liabilities of RM66.6m due within a year, and liabilities of RM227.7m falling due after that. Offsetting these obligations, it had cash of RM13.8m as well as receivables valued at RM22.3m due within 12 months. So its liabilities total RM258.2m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the RM70.3m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Digistar Corporation Berhad would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Digistar Corporation Berhad shareholders face the double whammy of a high net debt to EBITDA ratio (10.3), and fairly weak interest coverage, since EBIT is just 1.1 times the interest expense. The debt burden here is substantial. Another concern for investors might be that Digistar Corporation Berhad's EBIT fell 20% in the last year. If that's the way things keep going handling the debt load will be like delivering hot coffees on a pogo stick. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Digistar Corporation Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Digistar Corporation Berhad actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

On the face of it, Digistar Corporation Berhad's interest cover left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Overall, it seems to us that Digistar Corporation Berhad's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 4 warning signs we've spotted with Digistar Corporation Berhad (including 1 which is makes us a bit uncomfortable) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade Digistar Corporation Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:DIGISTA

Digistar Corporation Berhad

An investment holding company, provides system integration services in Malaysia.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026