We Wouldn't Rely On ARB Berhad's (KLSE:ARBB) Statutory Earnings As A Guide

Broadly speaking, profitable businesses are less risky than unprofitable ones. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. This article will consider whether ARB Berhad's (KLSE:ARBB) statutory profits are a good guide to its underlying earnings.

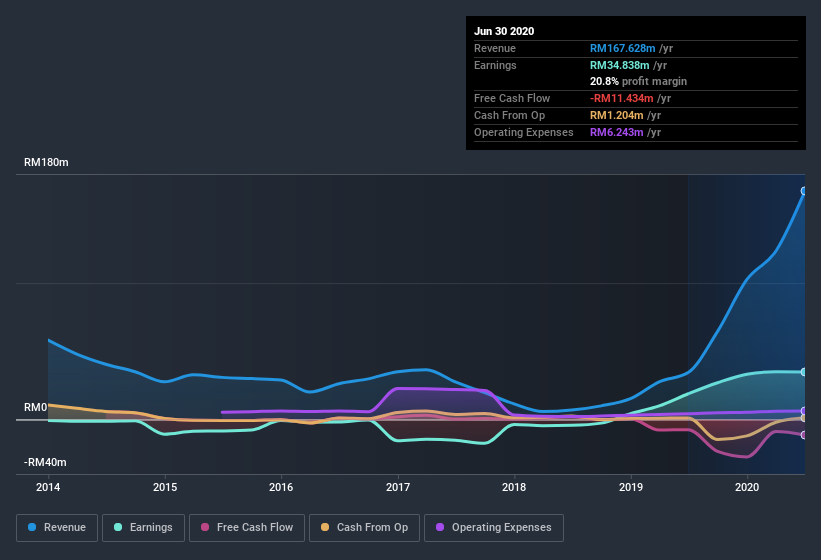

While ARB Berhad was able to generate revenue of RM167.6m in the last twelve months, we think its profit result of RM34.8m was more important. The good news is that the company managed to grow its revenue over the last three years, and also move from loss-making to profitable.

Check out our latest analysis for ARB Berhad

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. As a result, we'll today take a look at how dilution and cashflow shape our understanding of ARB Berhad's earnings. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of ARB Berhad.

A Closer Look At ARB Berhad's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

ARB Berhad has an accrual ratio of 0.60 for the year to June 2020. As a general rule, that bodes poorly for future profitability. And indeed, during the period the company didn't produce any free cash flow whatsoever. In the last twelve months it actually had negative free cash flow, with an outflow of RM11m despite its profit of RM34.8m, mentioned above. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of RM11m, this year, indicates high risk. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, ARB Berhad issued 62% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out ARB Berhad's historical EPS growth by clicking on this link.

A Look At The Impact Of ARB Berhad's Dilution on Its Earnings Per Share (EPS).

ARB Berhad was losing money three years ago. On the bright side, in the last twelve months it grew profit by 84%. But EPS was far less impressive, dropping 53% in that time. This is a great example of why it's rather imprudent to rely only on net income as a growth measure. And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

In the long term, if ARB Berhad's earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On ARB Berhad's Profit Performance

As it turns out, ARB Berhad couldn't match its profit with cashflow and its dilution means that shareholders own less of the company than the did before (unless they bought more shares). For all the reasons mentioned above, we think that, at a glance, ARB Berhad's statutory profits could be considered to be low quality, because they are likely to give investors an overly positive impression of the company. So while earnings quality is important, it's equally important to consider the risks facing ARB Berhad at this point in time. Our analysis shows 4 warning signs for ARB Berhad (2 are significant!) and we strongly recommend you look at these before investing.

Our examination of ARB Berhad has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade ARB Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:ARBB

ARB Berhad

An investment holding company, designs and develops Cloud, Customer Relationship Management (CRM), and platform solutions in Malaysia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives