- Malaysia

- /

- Semiconductors

- /

- KLSE:VIS

We Think Shareholders Are Less Likely To Approve A Large Pay Rise For Visdynamics Holdings Berhad's (KLSE:VIS) CEO For Now

Visdynamics Holdings Berhad (KLSE:VIS) has exhibited strong share price growth in the past few years. However, its earnings growth has not kept up, suggesting that there may be something amiss. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 30 March 2021. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

Check out our latest analysis for Visdynamics Holdings Berhad

How Does Total Compensation For Ngee Hoe Choy Compare With Other Companies In The Industry?

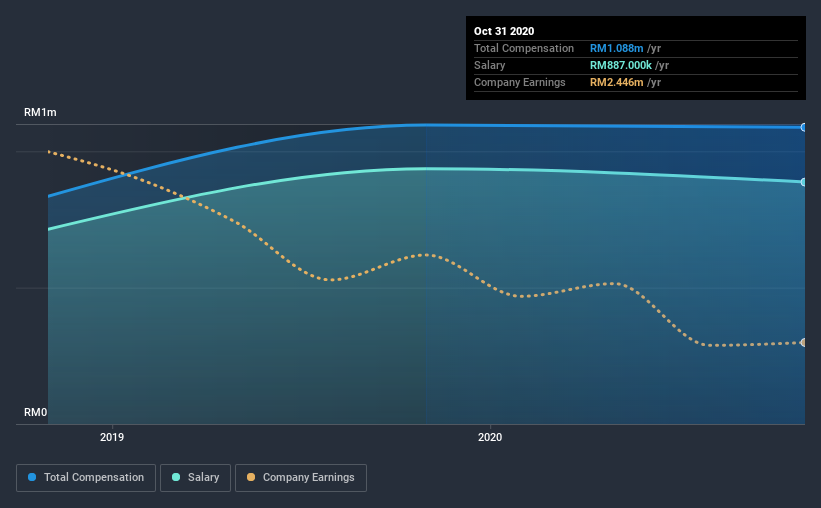

According to our data, Visdynamics Holdings Berhad has a market capitalization of RM250m, and paid its CEO total annual compensation worth RM1.1m over the year to October 2020. That's mostly flat as compared to the prior year's compensation. Notably, the salary which is RM887.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below RM823m, we found that the median total CEO compensation was RM748k. This suggests that Ngee Hoe Choy is paid more than the median for the industry. What's more, Ngee Hoe Choy holds RM66m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | RM887k | RM936k | 82% |

| Other | RM201k | RM160k | 18% |

| Total Compensation | RM1.1m | RM1.1m | 100% |

Talking in terms of the industry, salary represented approximately 85% of total compensation out of all the companies we analyzed, while other remuneration made up 15% of the pie. Although there is a difference in how total compensation is set, Visdynamics Holdings Berhad more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Visdynamics Holdings Berhad's Growth Numbers

Over the last three years, Visdynamics Holdings Berhad has shrunk its earnings per share by 29% per year. It saw its revenue drop 21% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Visdynamics Holdings Berhad Been A Good Investment?

Boasting a total shareholder return of 253% over three years, Visdynamics Holdings Berhad has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean returns may be hard to keep up. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 3 warning signs for Visdynamics Holdings Berhad that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Visdynamics Holdings Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:VIS

Visdynamics Holdings Berhad

Engages in the research and development, design, assembly, and tuning of test and backend equipment in the automated test equipment industry for semiconductors and non-semiconductors in Malaysia, South East Asia, North Asia, and internationally.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success