- Malaysia

- /

- Semiconductors

- /

- KLSE:KEYASIC

Is Key ASIC Berhad (KLSE:KEYASIC) In A Good Position To Deliver On Growth Plans?

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So should Key ASIC Berhad (KLSE:KEYASIC) shareholders be worried about its cash burn? For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for Key ASIC Berhad

When Might Key ASIC Berhad Run Out Of Money?

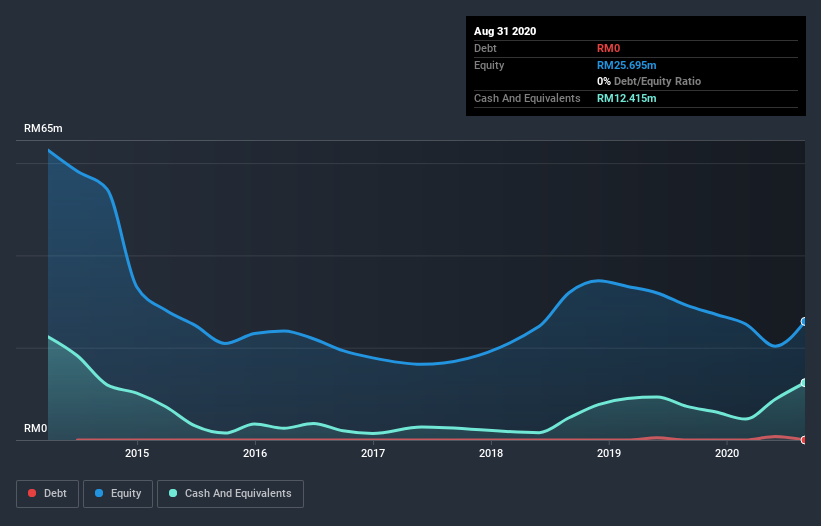

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. Key ASIC Berhad has such a small amount of debt that we'll set it aside, and focus on the RM12m in cash it held at August 2020. Looking at the last year, the company burnt through RM6.5m. That means it had a cash runway of around 23 months as of August 2020. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. The image below shows how its cash balance has been changing over the last few years.

How Well Is Key ASIC Berhad Growing?

It was quite stunning to see that Key ASIC Berhad increased its cash burn by 1,709% over the last year. While that's concerning on it's own, the fact that operating revenue was actually down 34% over the same period makes us positively tremulous. Considering these two factors together makes us nervous about the direction the company seems to be heading. In reality, this article only makes a short study of the company's growth data. This graph of historic earnings and revenue shows how Key ASIC Berhad is building its business over time.

How Hard Would It Be For Key ASIC Berhad To Raise More Cash For Growth?

Since Key ASIC Berhad can't yet boast improving growth metrics, the market will likely be considering how it can raise more cash if need be. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of RM82m, Key ASIC Berhad's RM6.5m in cash burn equates to about 7.9% of its market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

How Risky Is Key ASIC Berhad's Cash Burn Situation?

On this analysis of Key ASIC Berhad's cash burn, we think its cash burn relative to its market cap was reassuring, while its increasing cash burn has us a bit worried. Even though we don't think it has a problem with its cash burn, the analysis we've done in this article does suggest that shareholders should give some careful thought to the potential cost of raising more money in the future. An in-depth examination of risks revealed 3 warning signs for Key ASIC Berhad that readers should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you decide to trade Key ASIC Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Key ASIC Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:KEYASIC

Key ASIC Berhad

Provides application-specific integrated circuit design services in Malaysia, Taiwan, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives