- Malaysia

- /

- Semiconductors

- /

- KLSE:FPGROUP

I Built A List Of Growing Companies And FoundPac Group Berhad (KLSE:FPGROUP) Made The Cut

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like FoundPac Group Berhad (KLSE:FPGROUP), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for FoundPac Group Berhad

How Quickly Is FoundPac Group Berhad Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. FoundPac Group Berhad managed to grow EPS by 11% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

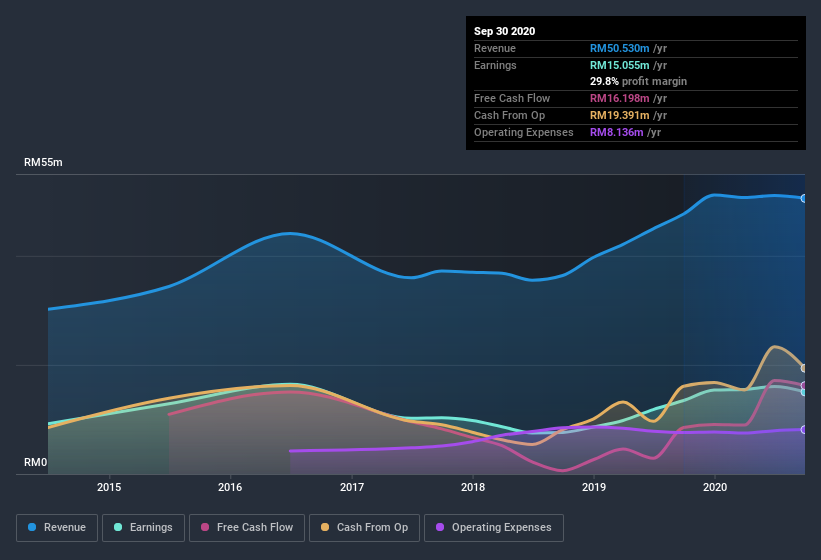

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. FoundPac Group Berhad maintained stable EBIT margins over the last year, all while growing revenue 5.9% to RM51m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

FoundPac Group Berhad isn't a huge company, given its market capitalization of RM523m. That makes it extra important to check on its balance sheet strength.

Are FoundPac Group Berhad Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that FoundPac Group Berhad insiders have a significant amount of capital invested in the stock. Indeed, they hold RM83m worth of its stock. That's a lot of money, and no small incentive to work hard. Those holdings account for over 16% of the company; visible skin in the game.

Does FoundPac Group Berhad Deserve A Spot On Your Watchlist?

One important encouraging feature of FoundPac Group Berhad is that it is growing profits. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. It is worth noting though that we have found 1 warning sign for FoundPac Group Berhad that you need to take into consideration.

Although FoundPac Group Berhad certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading FoundPac Group Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:FPGROUP

FoundPac Group Berhad

An investment holding company, designs, develops, manufactures, markets, and sells semiconductor products in Malaysia, rest of Asia, Europe, the United States, and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives