- Malaysia

- /

- Specialty Stores

- /

- KLSE:MSTGOLF

Investors Continue Waiting On Sidelines For MST Golf Group Berhad (KLSE:MSTGOLF)

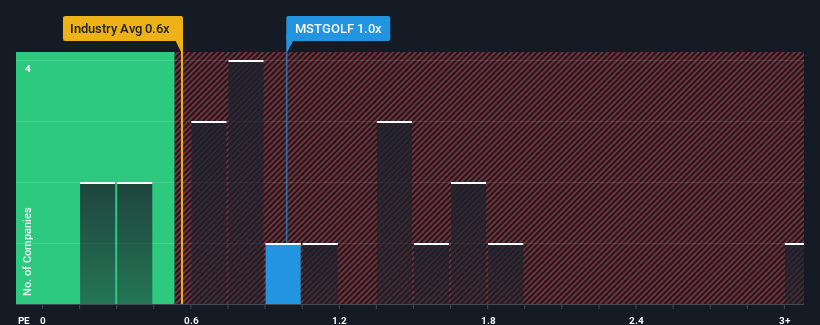

With a median price-to-sales (or "P/S") ratio of close to 0.9x in the Specialty Retail industry in Malaysia, you could be forgiven for feeling indifferent about MST Golf Group Berhad's (KLSE:MSTGOLF) P/S ratio of 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for MST Golf Group Berhad

How MST Golf Group Berhad Has Been Performing

MST Golf Group Berhad has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. Those who are bullish on MST Golf Group Berhad will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on MST Golf Group Berhad will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like MST Golf Group Berhad's to be considered reasonable.

Retrospectively, the last year delivered a decent 8.2% gain to the company's revenues. Pleasingly, revenue has also lifted 91% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 12% shows it's noticeably more attractive.

With this information, we find it interesting that MST Golf Group Berhad is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On MST Golf Group Berhad's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We didn't quite envision MST Golf Group Berhad's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Having said that, be aware MST Golf Group Berhad is showing 4 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MSTGOLF

MST Golf Group Berhad

An investment holding company, engages in the retail and wholesale of golf equipment in Malaysia, Singapore, Indonesia, Thailand, Vietnam, and internationally.

Excellent balance sheet with moderate risk.

Market Insights

Community Narratives