Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Tiger Synergy Berhad (KLSE:TIGER) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Tiger Synergy Berhad

What Is Tiger Synergy Berhad's Debt?

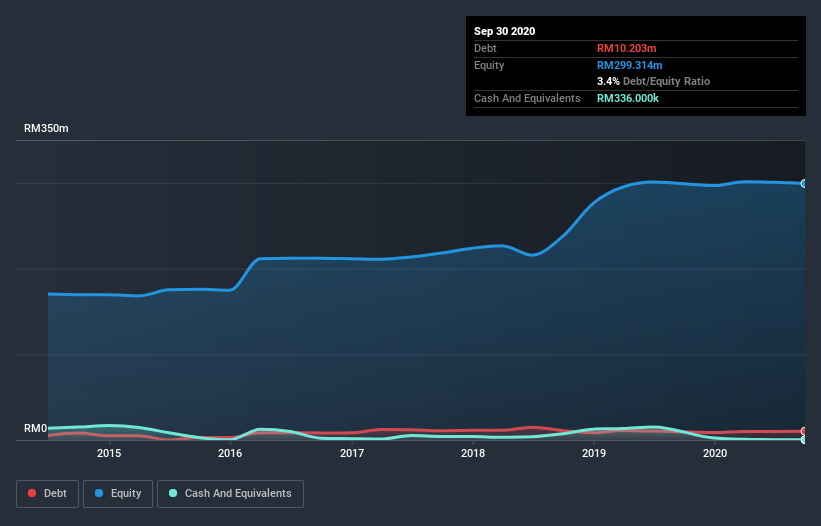

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Tiger Synergy Berhad had RM10.2m of debt, an increase on RM8.68m, over one year. However, it does have RM336.0k in cash offsetting this, leading to net debt of about RM9.87m.

How Healthy Is Tiger Synergy Berhad's Balance Sheet?

The latest balance sheet data shows that Tiger Synergy Berhad had liabilities of RM13.6m due within a year, and liabilities of RM488.0k falling due after that. Offsetting this, it had RM336.0k in cash and RM45.9m in receivables that were due within 12 months. So it can boast RM32.2m more liquid assets than total liabilities.

It's good to see that Tiger Synergy Berhad has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Tiger Synergy Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Tiger Synergy Berhad had a loss before interest and tax, and actually shrunk its revenue by 96%, to RM569k. To be frank that doesn't bode well.

Caveat Emptor

While Tiger Synergy Berhad's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. To be specific the EBIT loss came in at RM14m. On a more positive note, the company does have liquid assets, so it has a bit of time to improve its operations before the debt becomes an acute problem. But we'd be more likely to spend time trying to understand the stock if the company made a profit. So it seems too risky for our taste. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 5 warning signs for Tiger Synergy Berhad (2 are potentially serious) you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Tiger Synergy Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TWL Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:TWL

TWL Holdings Berhad

An investment holding company, engages in the property development and construction businesses in Malaysia.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives