- Malaysia

- /

- Real Estate

- /

- KLSE:SNTORIA

Sentoria Group Berhad (KLSE:SNTORIA) Has Debt But No Earnings; Should You Worry?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Sentoria Group Berhad (KLSE:SNTORIA) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Sentoria Group Berhad

What Is Sentoria Group Berhad's Debt?

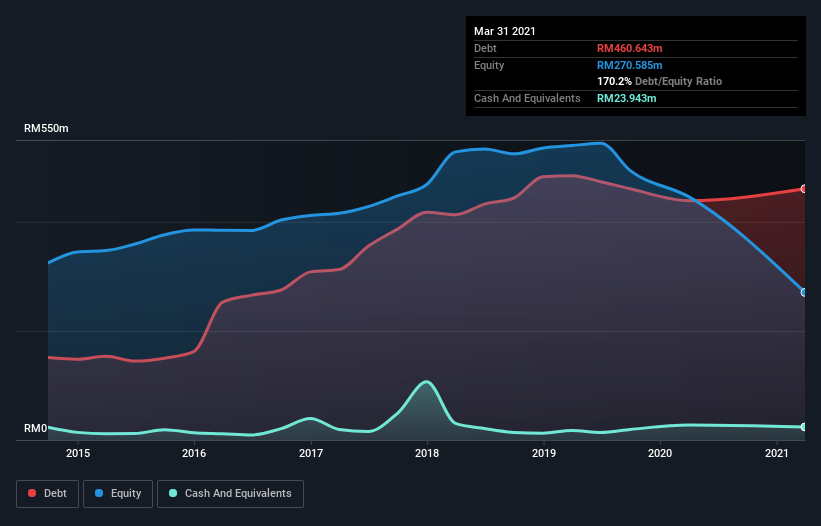

You can click the graphic below for the historical numbers, but it shows that as of March 2021 Sentoria Group Berhad had RM460.6m of debt, an increase on RM438.8m, over one year. On the flip side, it has RM23.9m in cash leading to net debt of about RM436.7m.

A Look At Sentoria Group Berhad's Liabilities

The latest balance sheet data shows that Sentoria Group Berhad had liabilities of RM711.0m due within a year, and liabilities of RM12.1m falling due after that. Offsetting this, it had RM23.9m in cash and RM108.8m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM590.4m.

This deficit casts a shadow over the RM86.4m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Sentoria Group Berhad would probably need a major re-capitalization if its creditors were to demand repayment. When analysing debt levels, the balance sheet is the obvious place to start. But it is Sentoria Group Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Sentoria Group Berhad had a loss before interest and tax, and actually shrunk its revenue by 74%, to RM35m. To be frank that doesn't bode well.

Caveat Emptor

While Sentoria Group Berhad's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost a very considerable RM106m at the EBIT level. Reflecting on this and the significant total liabilities, it's hard to know what to say about the stock because of our intense dis-affinity for it. Like every long-shot we're sure it has a glossy presentation outlining its blue-sky potential. But the reality is that it is low on liquid assets relative to liabilities, and it lost RM162m in the last year. So we're not very excited about owning this stock. Its too risky for us. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 4 warning signs we've spotted with Sentoria Group Berhad (including 2 which are a bit concerning) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:SNTORIA

Sentoria Group Berhad

An investment holding company, engages in the property development and construction business in Malaysia.

Low risk and slightly overvalued.

Market Insights

Community Narratives