- Malaysia

- /

- Real Estate

- /

- KLSE:MAXIM

If You Had Bought Maxim Global Berhad (KLSE:MAXIM) Stock Five Years Ago, You Could Pocket A 18% Gain Today

Stock pickers are generally looking for stocks that will outperform the broader market. Buying under-rated businesses is one path to excess returns. To wit, the Maxim Global Berhad share price has climbed 18% in five years, easily topping the market decline of 6.1% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 8.9%.

See our latest analysis for Maxim Global Berhad

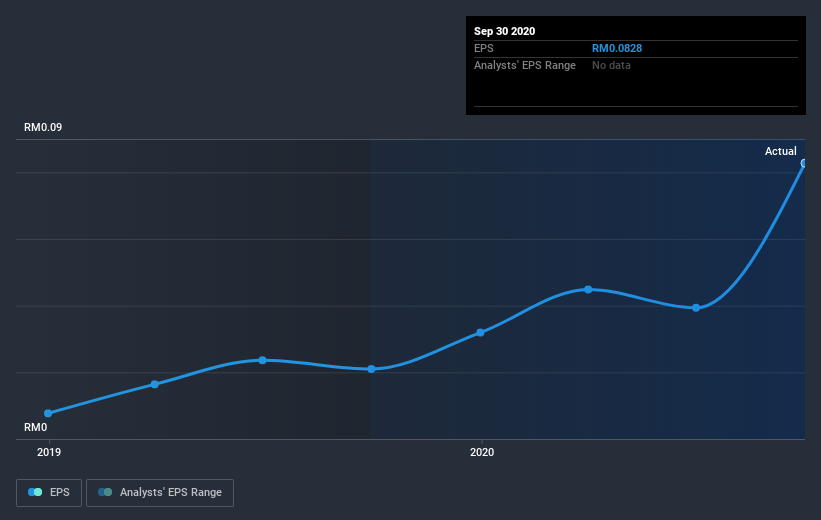

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Maxim Global Berhad moved from a loss to profitability. That's generally thought to be a genuine positive, so we would expect to see an increasing share price.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Maxim Global Berhad's key metrics by checking this interactive graph of Maxim Global Berhad's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Maxim Global Berhad shareholders have received a total shareholder return of 8.9% over the last year. That's better than the annualised return of 3% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Maxim Global Berhad (1 shouldn't be ignored) that you should be aware of.

Of course Maxim Global Berhad may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you decide to trade Maxim Global Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:MAXIM

Maxim Global Berhad

Engages in the property development and construction businesses in Malaysia.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives