- Malaysia

- /

- Real Estate

- /

- KLSE:YONGTAI

Optimistic Investors Push Yong Tai Berhad (KLSE:YONGTAI) Shares Up 54% But Growth Is Lacking

Yong Tai Berhad (KLSE:YONGTAI) shares have had a really impressive month, gaining 54% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 27% in the last twelve months.

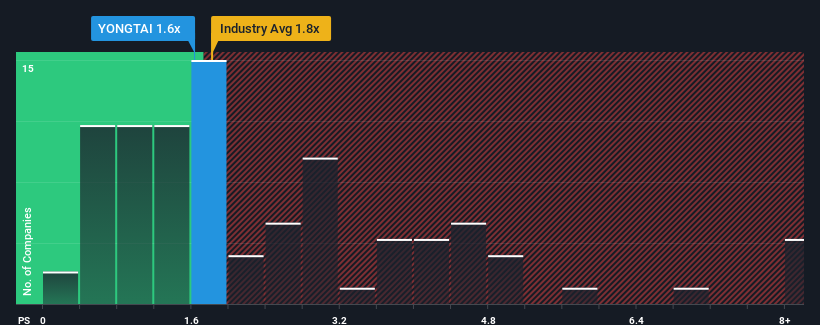

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Yong Tai Berhad's P/S ratio of 1.6x, since the median price-to-sales (or "P/S") ratio for the Real Estate industry in Malaysia is also close to 1.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Yong Tai Berhad

What Does Yong Tai Berhad's Recent Performance Look Like?

For example, consider that Yong Tai Berhad's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Yong Tai Berhad will help you shine a light on its historical performance.How Is Yong Tai Berhad's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Yong Tai Berhad's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 41%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 10% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 9.9% shows it's noticeably less attractive.

With this in mind, we find it intriguing that Yong Tai Berhad's P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Yong Tai Berhad appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Yong Tai Berhad's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

You need to take note of risks, for example - Yong Tai Berhad has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:YONGTAI

Yong Tai Berhad

An investment holding company, engages in the tourism-related property development business in Malaysia.

Imperfect balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives