- Malaysia

- /

- Real Estate

- /

- KLSE:YNHPROP

YNH Property Bhd's (KLSE:YNHPROP) 26% Share Price Plunge Could Signal Some Risk

The YNH Property Bhd (KLSE:YNHPROP) share price has fared very poorly over the last month, falling by a substantial 26%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 13% in that time.

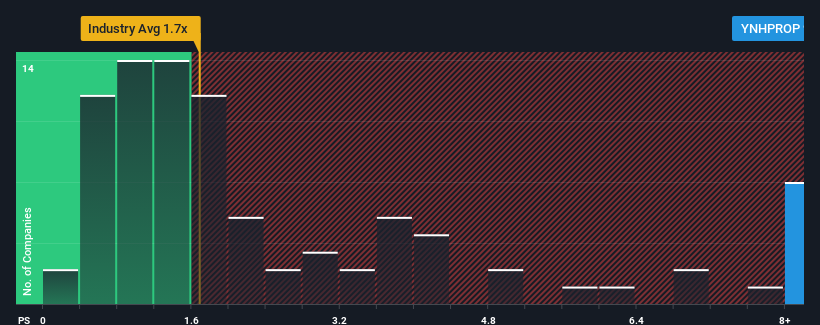

Although its price has dipped substantially, given around half the companies in Malaysia's Real Estate industry have price-to-sales ratios (or "P/S") below 1.7x, you may still consider YNH Property Bhd as a stock to avoid entirely with its 9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for YNH Property Bhd

How Has YNH Property Bhd Performed Recently?

For example, consider that YNH Property Bhd's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on YNH Property Bhd will help you shine a light on its historical performance.How Is YNH Property Bhd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as YNH Property Bhd's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 13% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 9.0% shows it's an unpleasant look.

With this information, we find it concerning that YNH Property Bhd is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From YNH Property Bhd's P/S?

Even after such a strong price drop, YNH Property Bhd's P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of YNH Property Bhd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with YNH Property Bhd, and understanding these should be part of your investment process.

If you're unsure about the strength of YNH Property Bhd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:YNHPROP

YNH Property Bhd

An investment holding company, engages in the development, construction, and sale of residential and commercial properties in Malaysia.

Good value with adequate balance sheet.

Market Insights

Community Narratives