Stock Analysis

- Malaysia

- /

- Real Estate

- /

- KLSE:SIMEPROP

Sime Darby Property Berhad's (KLSE:SIMEPROP) Stock Has Seen Strong Momentum: Does That Call For Deeper Study Of Its Financial Prospects?

Sime Darby Property Berhad (KLSE:SIMEPROP) has had a great run on the share market with its stock up by a significant 71% over the last three months. As most would know, fundamentals are what usually guide market price movements over the long-term, so we decided to look at the company's key financial indicators today to determine if they have any role to play in the recent price movement. In this article, we decided to focus on Sime Darby Property Berhad's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for Sime Darby Property Berhad

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Sime Darby Property Berhad is:

4.7% = RM484m ÷ RM10b (Based on the trailing twelve months to March 2024).

The 'return' is the income the business earned over the last year. One way to conceptualize this is that for each MYR1 of shareholders' capital it has, the company made MYR0.05 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Sime Darby Property Berhad's Earnings Growth And 4.7% ROE

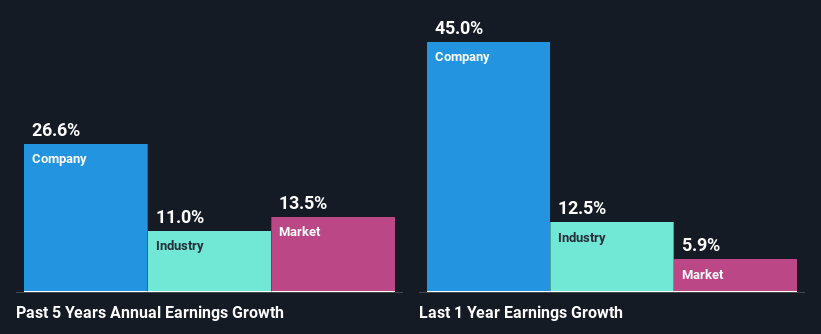

It is hard to argue that Sime Darby Property Berhad's ROE is much good in and of itself. A comparison with the industry shows that the company's ROE is pretty similar to the average industry ROE of 4.5%. Moreover, we are quite pleased to see that Sime Darby Property Berhad's net income grew significantly at a rate of 27% over the last five years. Considering the low ROE, it is quite possible that there might also be some other aspects that are positively influencing the company's earnings growth. Such as - high earnings retention or an efficient management in place.

As a next step, we compared Sime Darby Property Berhad's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 11%.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Sime Darby Property Berhad is trading on a high P/E or a low P/E, relative to its industry.

Is Sime Darby Property Berhad Making Efficient Use Of Its Profits?

Sime Darby Property Berhad's three-year median payout ratio is a pretty moderate 42%, meaning the company retains 58% of its income. By the looks of it, the dividend is well covered and Sime Darby Property Berhad is reinvesting its profits efficiently as evidenced by its exceptional growth which we discussed above.

Moreover, Sime Darby Property Berhad is determined to keep sharing its profits with shareholders which we infer from its long history of six years of paying a dividend. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 42%. Accordingly, forecasts suggest that Sime Darby Property Berhad's future ROE will be 4.6% which is again, similar to the current ROE.

Conclusion

On the whole, we do feel that Sime Darby Property Berhad has some positive attributes. With a high rate of reinvestment, albeit at a low ROE, the company has managed to see a considerable growth in its earnings. With that said, the latest industry analyst forecasts reveal that the company's earnings growth is expected to slow down. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:SIMEPROP

Sime Darby Property Berhad

An investment holding company, engages in the property development, investment and asset management, and leisure activities in Malaysia, Singapore, and the United Kingdom.

Solid track record with excellent balance sheet.