Stock Analysis

- Malaysia

- /

- Construction

- /

- KLSE:SCBUILD

Even after rising 100% this past week, SC Estate Builder Berhad (KLSE:SCBUILD) shareholders are still down 40% over the past three years

For many investors, the main point of stock picking is to generate higher returns than the overall market. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term SC Estate Builder Berhad (KLSE:SCBUILD) shareholders have had that experience, with the share price dropping 73% in three years, versus a market return of about 25%.

On a more encouraging note the company has added RM41m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

View our latest analysis for SC Estate Builder Berhad

With just RM2,662,000 worth of revenue in twelve months, we don't think the market considers SC Estate Builder Berhad to have proven its business plan. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that SC Estate Builder Berhad will significantly advance the business plan before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that the company needed to issue more shares recently so that it could raise enough money to continue pursuing its business plan. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). SC Estate Builder Berhad has already given some investors a taste of the bitter losses that high risk investing can cause.

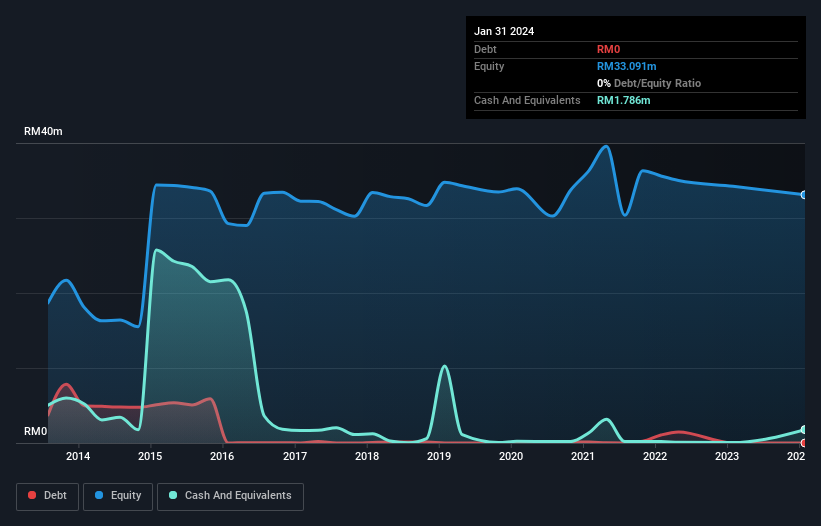

SC Estate Builder Berhad had liabilities exceeding cash when it last reported, according to our data. That put it in the highest risk category, according to our analysis. But since the share price has dived 36% per year, over 3 years , it looks like some investors think it's time to abandon ship, so to speak, even though the cash reserves look a little better with the capital raising. You can see in the image below, how SC Estate Builder Berhad's cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. What if insiders are ditching the stock hand over fist? I would feel more nervous about the company if that were so. It only takes a moment for you to check whether we have identified any insider sales recently.

What About The Total Shareholder Return (TSR)?

We've already covered SC Estate Builder Berhad's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that SC Estate Builder Berhad's TSR, at -40% is higher than its share price return of -73%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

It's good to see that SC Estate Builder Berhad has rewarded shareholders with a total shareholder return of 29% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 0.0002% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand SC Estate Builder Berhad better, we need to consider many other factors. For instance, we've identified 5 warning signs for SC Estate Builder Berhad (4 are potentially serious) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:SCBUILD

SC Estate Builder Berhad

An investment holding company, engages in the construction and related activities in Malaysia.

Excellent balance sheet moderate.