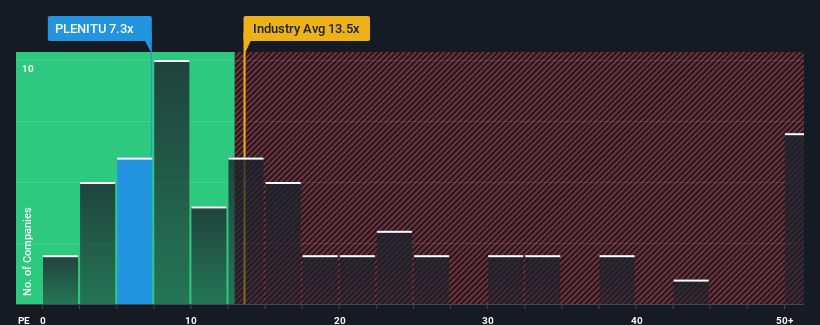

With a price-to-earnings (or "P/E") ratio of 7.3x Plenitude Berhad (KLSE:PLENITU) may be sending very bullish signals at the moment, given that almost half of all companies in Malaysia have P/E ratios greater than 16x and even P/E's higher than 29x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Plenitude Berhad has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Plenitude Berhad

How Is Plenitude Berhad's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Plenitude Berhad's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 146% last year. The latest three year period has also seen an excellent 2,706% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 17% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that Plenitude Berhad is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Plenitude Berhad's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Plenitude Berhad currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Plenitude Berhad that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PLENITU

Plenitude Berhad

An investment holding company, engages in real estate development business in Malaysia.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success