- Malaysia

- /

- Real Estate

- /

- KLSE:MUIPROP

The Market Lifts MUI Properties Berhad (KLSE:MUIPROP) Shares 63% But It Can Do More

MUI Properties Berhad (KLSE:MUIPROP) shareholders have had their patience rewarded with a 63% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 94%.

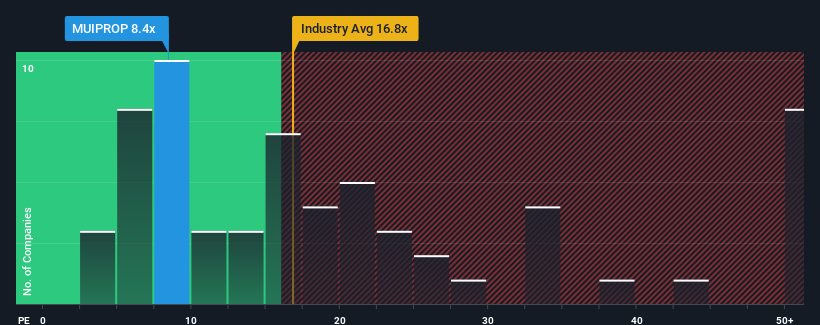

Although its price has surged higher, given about half the companies in Malaysia have price-to-earnings ratios (or "P/E's") above 19x, you may still consider MUI Properties Berhad as a highly attractive investment with its 8.4x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

MUI Properties Berhad certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for MUI Properties Berhad

How Is MUI Properties Berhad's Growth Trending?

In order to justify its P/E ratio, MUI Properties Berhad would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered an exceptional 200% gain to the company's bottom line. The latest three year period has also seen an excellent 115% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 18% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that MUI Properties Berhad's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

MUI Properties Berhad's recent share price jump still sees its P/E sitting firmly flat on the ground. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that MUI Properties Berhad currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

It is also worth noting that we have found 3 warning signs for MUI Properties Berhad (1 doesn't sit too well with us!) that you need to take into consideration.

Of course, you might also be able to find a better stock than MUI Properties Berhad. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:MUIPROP

MUI Properties Berhad

An investment holding company, engages in property investment and development business in Malaysia.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives