- Malaysia

- /

- Real Estate

- /

- KLSE:IOIPG

There's No Escaping IOI Properties Group Berhad's (KLSE:IOIPG) Muted Earnings

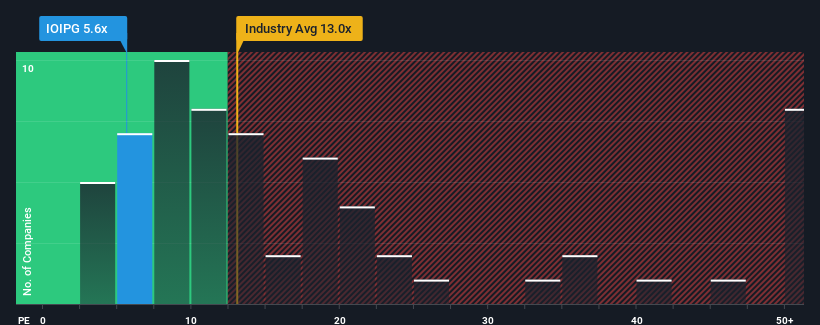

When close to half the companies in Malaysia have price-to-earnings ratios (or "P/E's") above 16x, you may consider IOI Properties Group Berhad (KLSE:IOIPG) as a highly attractive investment with its 5.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been advantageous for IOI Properties Group Berhad as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for IOI Properties Group Berhad

How Is IOI Properties Group Berhad's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like IOI Properties Group Berhad's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 48% last year. Pleasingly, EPS has also lifted 212% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 23% per annum as estimated by the eight analysts watching the company. With the market predicted to deliver 14% growth per annum, that's a disappointing outcome.

In light of this, it's understandable that IOI Properties Group Berhad's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that IOI Properties Group Berhad maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 3 warning signs for IOI Properties Group Berhad (2 make us uncomfortable!) that we have uncovered.

If you're unsure about the strength of IOI Properties Group Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:IOIPG

IOI Properties Group Berhad

An investment holding company, engages in the property development activities in Malaysia, Singapore, and the People's Republic of China.

Slight risk second-rate dividend payer.

Market Insights

Community Narratives