- Malaysia

- /

- Life Sciences

- /

- KLSE:MGRC

Malaysian Genomics Resource Centre Berhad (KLSE:MGRC) Shareholders Received A Total Return Of 50% In The Last Five Years

Over the last month the Malaysian Genomics Resource Centre Berhad (KLSE:MGRC) has been much stronger than before, rebounding by 64%.

Check out our latest analysis for Malaysian Genomics Resource Centre Berhad

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Malaysian Genomics Resource Centre Berhad became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

Revenue is actually up 20% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

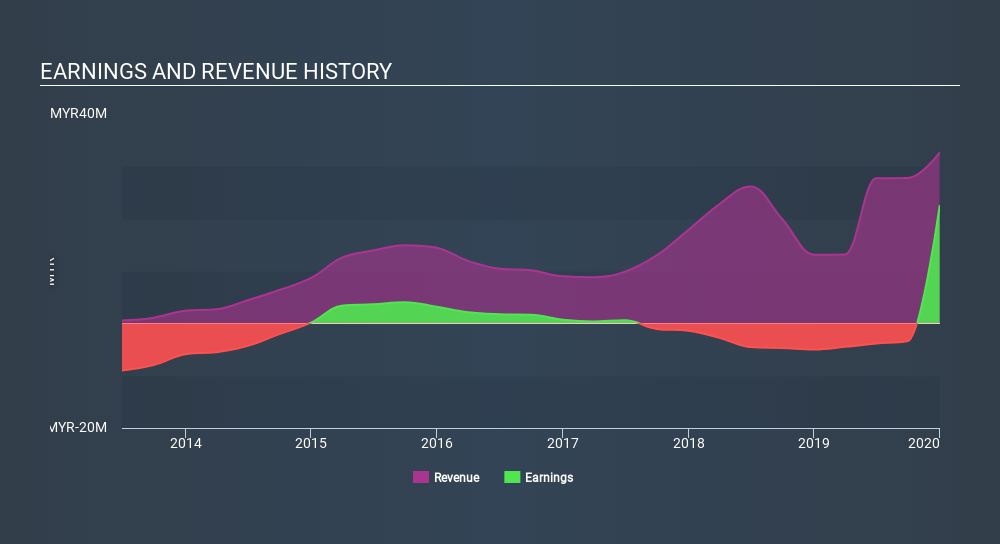

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Malaysian Genomics Resource Centre Berhad's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered Malaysian Genomics Resource Centre Berhad's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Malaysian Genomics Resource Centre Berhad shareholders, and that cash payout contributed to why its TSR of 50%, over the last 5 years, is better than the share price return.

A Different Perspective

It's nice to see that Malaysian Genomics Resource Centre Berhad shareholders have received a total shareholder return of 169% over the last year. That gain is better than the annual TSR over five years, which is 8.5%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Malaysian Genomics Resource Centre Berhad better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Malaysian Genomics Resource Centre Berhad you should be aware of, and 2 of them are a bit unpleasant.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About KLSE:MGRC

Malaysian Genomics Resource Centre Berhad

Provides genetics, genomics, immunotherapy, and biopharmaceutical services worldwide.

Flawless balance sheet with low risk.

Market Insights

Community Narratives