- Malaysia

- /

- Metals and Mining

- /

- KLSE:MSC

Shareholders Will Probably Hold Off On Increasing Malaysia Smelting Corporation Berhad's (KLSE:MSC) CEO Compensation For The Time Being

Key Insights

- Malaysia Smelting Corporation Berhad to hold its Annual General Meeting on 29th of May

- Salary of RM1.10m is part of CEO Patrick Yong's total remuneration

- The total compensation is 334% higher than the average for the industry

- Malaysia Smelting Corporation Berhad's total shareholder return over the past three years was 69% while its EPS grew by 75% over the past three years

CEO Patrick Yong has done a decent job of delivering relatively good performance at Malaysia Smelting Corporation Berhad (KLSE:MSC) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 29th of May. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

See our latest analysis for Malaysia Smelting Corporation Berhad

Comparing Malaysia Smelting Corporation Berhad's CEO Compensation With The Industry

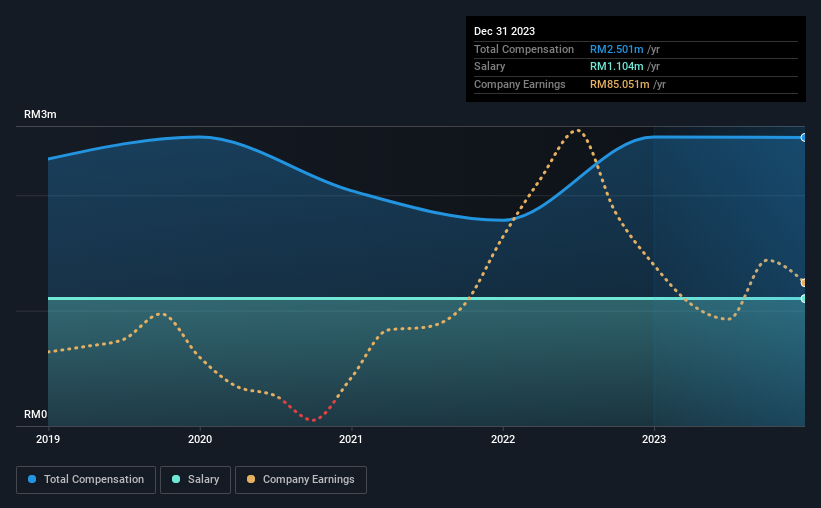

According to our data, Malaysia Smelting Corporation Berhad has a market capitalization of RM1.4b, and paid its CEO total annual compensation worth RM2.5m over the year to December 2023. That is, the compensation was roughly the same as last year. We think total compensation is more important but our data shows that the CEO salary is lower, at RM1.1m.

For comparison, other companies in the Malaysian Metals and Mining industry with market capitalizations ranging between RM939m and RM3.8b had a median total CEO compensation of RM576k. Hence, we can conclude that Patrick Yong is remunerated higher than the industry median. Furthermore, Patrick Yong directly owns RM1.6m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | RM1.1m | RM1.1m | 44% |

| Other | RM1.4m | RM1.4m | 56% |

| Total Compensation | RM2.5m | RM2.5m | 100% |

Talking in terms of the industry, salary represented approximately 69% of total compensation out of all the companies we analyzed, while other remuneration made up 31% of the pie. Malaysia Smelting Corporation Berhad pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Malaysia Smelting Corporation Berhad's Growth

Over the past three years, Malaysia Smelting Corporation Berhad has seen its earnings per share (EPS) grow by 75% per year. Its revenue is down 4.5% over the previous year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. While it would be good to see revenue growth, profits matter more in the end. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Malaysia Smelting Corporation Berhad Been A Good Investment?

We think that the total shareholder return of 69%, over three years, would leave most Malaysia Smelting Corporation Berhad shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 1 warning sign for Malaysia Smelting Corporation Berhad that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MSC

Malaysia Smelting Corporation Berhad

An investment holding company, engages in the smelting tin concentrates and tin bearing materials primarily in Malaysia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives