- Malaysia

- /

- Metals and Mining

- /

- KLSE:MSC

Market Might Still Lack Some Conviction On Malaysia Smelting Corporation Berhad (KLSE:MSC) Even After 26% Share Price Boost

Malaysia Smelting Corporation Berhad (KLSE:MSC) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 42% in the last year.

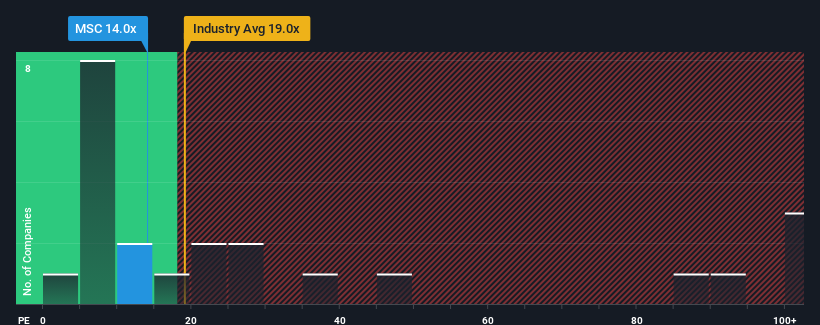

In spite of the firm bounce in price, Malaysia Smelting Corporation Berhad's price-to-earnings (or "P/E") ratio of 14x might still make it look like a buy right now compared to the market in Malaysia, where around half of the companies have P/E ratios above 17x and even P/E's above 30x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

While the market has experienced earnings growth lately, Malaysia Smelting Corporation Berhad's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Malaysia Smelting Corporation Berhad

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Malaysia Smelting Corporation Berhad would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 13%. Even so, admirably EPS has lifted 434% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 25% per year as estimated by the three analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 12% per annum, which is noticeably less attractive.

In light of this, it's peculiar that Malaysia Smelting Corporation Berhad's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Malaysia Smelting Corporation Berhad's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Malaysia Smelting Corporation Berhad's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Malaysia Smelting Corporation Berhad, and understanding should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MSC

Malaysia Smelting Corporation Berhad

An investment holding company, engages in the smelting tin concentrates and tin bearing materials primarily in Malaysia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success