- Malaysia

- /

- Metals and Mining

- /

- KLSE:MSC

Malaysia Smelting Corporation Berhad's (KLSE:MSC) Dividend Will Be MYR0.07

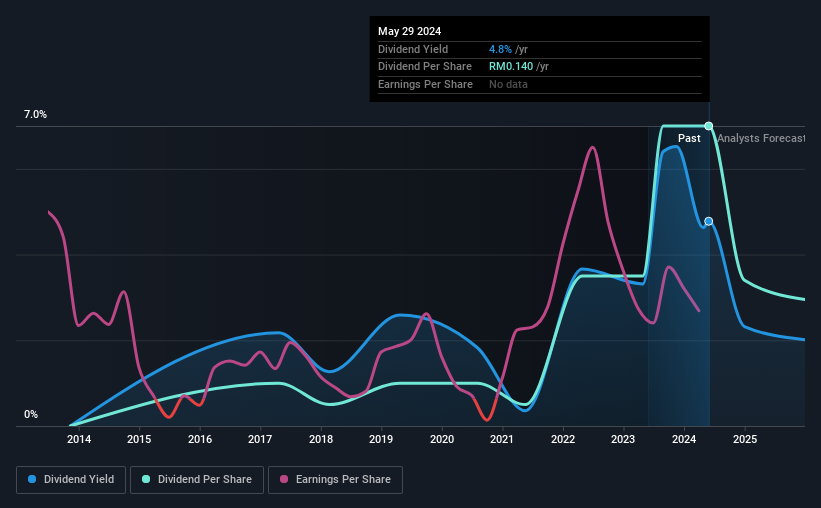

The board of Malaysia Smelting Corporation Berhad (KLSE:MSC) has announced that it will pay a dividend on the 28th of June, with investors receiving MYR0.07 per share. This means the annual payment is 4.8% of the current stock price, which is above the average for the industry.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Malaysia Smelting Corporation Berhad's stock price has increased by 43% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

View our latest analysis for Malaysia Smelting Corporation Berhad

Malaysia Smelting Corporation Berhad's Earnings Easily Cover The Distributions

If the payments aren't sustainable, a high yield for a few years won't matter that much. The last payment made up 87% of earnings, but cash flows were much higher. This leaves plenty of cash for reinvestment into the business.

Looking forward, earnings per share is forecast to rise by 130.1% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 51%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

Malaysia Smelting Corporation Berhad's Dividend Has Lacked Consistency

Looking back, Malaysia Smelting Corporation Berhad's dividend hasn't been particularly consistent. This makes us cautious about the consistency of the dividend over a full economic cycle. The annual payment during the last 7 years was MYR0.02 in 2017, and the most recent fiscal year payment was MYR0.14. This implies that the company grew its distributions at a yearly rate of about 32% over that duration. Malaysia Smelting Corporation Berhad has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

Malaysia Smelting Corporation Berhad Might Find It Hard To Grow Its Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. We are encouraged to see that Malaysia Smelting Corporation Berhad has grown earnings per share at 11% per year over the past five years. The payout ratio is very much on the higher end, which could mean that the growth rate will slow down in the future, and that could flow through to the dividend as well.

Our Thoughts On Malaysia Smelting Corporation Berhad's Dividend

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 1 warning sign for Malaysia Smelting Corporation Berhad that investors should know about before committing capital to this stock. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MSC

Malaysia Smelting Corporation Berhad

An investment holding company, engages in the smelting tin concentrates and tin bearing materials primarily in Malaysia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives