- Malaysia

- /

- Basic Materials

- /

- KLSE:MCEMENT

With EPS Growth And More, Malayan Cement Berhad (KLSE:MCEMENT) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Malayan Cement Berhad (KLSE:MCEMENT). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Fast Is Malayan Cement Berhad Growing Its Earnings Per Share?

Malayan Cement Berhad has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Malayan Cement Berhad's EPS shot up from RM0.30 to RM0.46; a result that's bound to keep shareholders happy. That's a impressive gain of 50%.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Despite the relatively flat revenue figures, shareholders will be pleased to see EBIT margins have grown from 16% to 20% in the last 12 months. That's something to smile about.

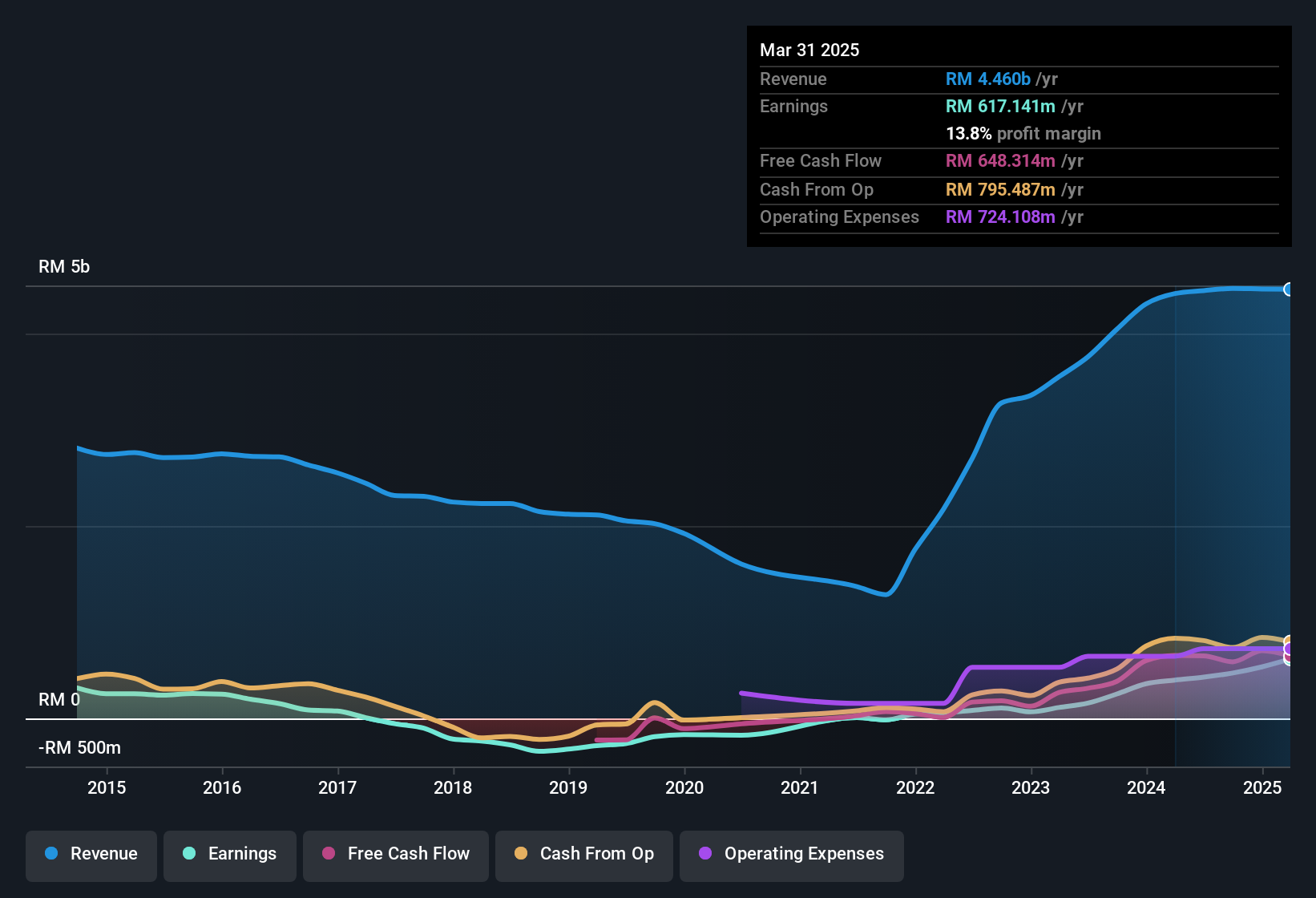

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Check out our latest analysis for Malayan Cement Berhad

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Malayan Cement Berhad.

Are Malayan Cement Berhad Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that Malayan Cement Berhad insiders have a significant amount of capital invested in the stock. Indeed, they hold RM52m worth of its stock. That's a lot of money, and no small incentive to work hard. Even though that's only about 0.8% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Is Malayan Cement Berhad Worth Keeping An Eye On?

You can't deny that Malayan Cement Berhad has grown its earnings per share at a very impressive rate. That's attractive. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. Now, you could try to make up your mind on Malayan Cement Berhad by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Although Malayan Cement Berhad certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Malaysian companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MCEMENT

Malayan Cement Berhad

An investment holding company, produces, manufactures, and trades in cement, clinker, ready-mix concrete, drymix, quarry, and other building materials and related products primarily in Malaysia and Singapore.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives