- Malaysia

- /

- Metals and Mining

- /

- KLSE:KSSC

Is K. Seng Seng Corporation Berhad (KLSE:KSSC) A Risky Investment?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies K. Seng Seng Corporation Berhad (KLSE:KSSC) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for K. Seng Seng Corporation Berhad

What Is K. Seng Seng Corporation Berhad's Net Debt?

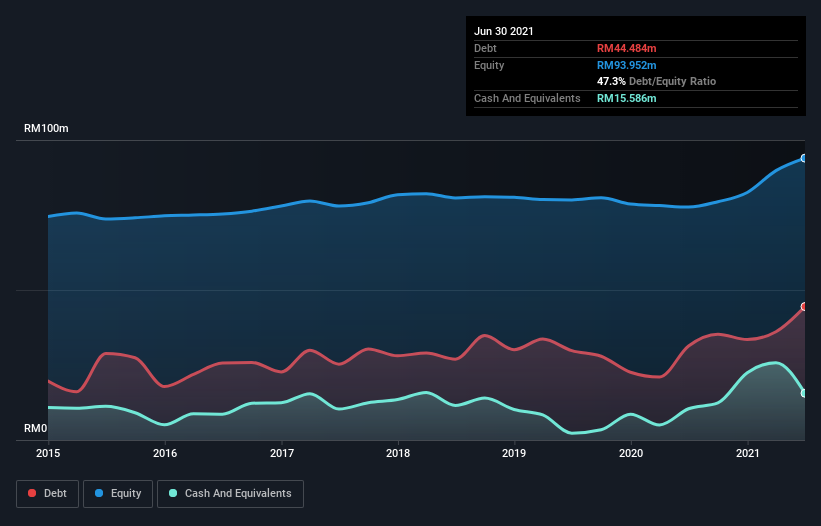

The image below, which you can click on for greater detail, shows that at June 2021 K. Seng Seng Corporation Berhad had debt of RM44.5m, up from RM31.4m in one year. On the flip side, it has RM15.6m in cash leading to net debt of about RM28.9m.

How Healthy Is K. Seng Seng Corporation Berhad's Balance Sheet?

According to the last reported balance sheet, K. Seng Seng Corporation Berhad had liabilities of RM68.0m due within 12 months, and liabilities of RM2.23m due beyond 12 months. Offsetting this, it had RM15.6m in cash and RM61.9m in receivables that were due within 12 months. So it can boast RM7.22m more liquid assets than total liabilities.

This surplus suggests that K. Seng Seng Corporation Berhad has a conservative balance sheet, and could probably eliminate its debt without much difficulty.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With a debt to EBITDA ratio of 2.2, K. Seng Seng Corporation Berhad uses debt artfully but responsibly. And the alluring interest cover (EBIT of 8.2 times interest expense) certainly does not do anything to dispel this impression. Pleasingly, K. Seng Seng Corporation Berhad is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 717% gain in the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But it is K. Seng Seng Corporation Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. During the last three years, K. Seng Seng Corporation Berhad burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

K. Seng Seng Corporation Berhad's EBIT growth rate suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But the stark truth is that we are concerned by its conversion of EBIT to free cash flow. Looking at all the aforementioned factors together, it strikes us that K. Seng Seng Corporation Berhad can handle its debt fairly comfortably. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 6 warning signs for K. Seng Seng Corporation Berhad (3 make us uncomfortable!) that you should be aware of before investing here.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if K. Seng Seng Corporation Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:KSSC

K. Seng Seng Corporation Berhad

An investment holding company, engages in the manufacture and processing of secondary stainless steel and other metal related products in Malaysia, the Republic of Singapore, Australia, the Republic of Indonesia, and Brunei.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success