- Malaysia

- /

- Metals and Mining

- /

- KLSE:KSSC

Is K. Seng Seng Corporation Berhad (KLSE:KSSC) A Risky Investment?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that K. Seng Seng Corporation Berhad (KLSE:KSSC) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for K. Seng Seng Corporation Berhad

What Is K. Seng Seng Corporation Berhad's Net Debt?

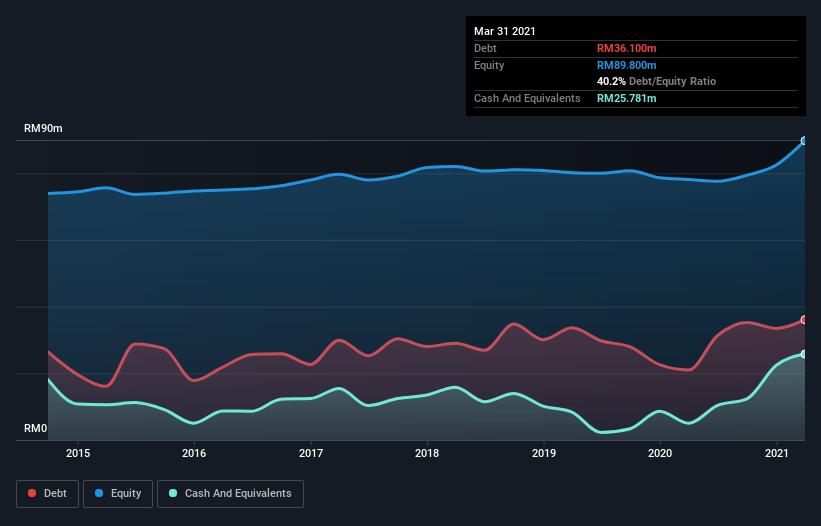

You can click the graphic below for the historical numbers, but it shows that as of March 2021 K. Seng Seng Corporation Berhad had RM36.1m of debt, an increase on RM21.0m, over one year. On the flip side, it has RM25.8m in cash leading to net debt of about RM10.3m.

A Look At K. Seng Seng Corporation Berhad's Liabilities

We can see from the most recent balance sheet that K. Seng Seng Corporation Berhad had liabilities of RM59.3m falling due within a year, and liabilities of RM2.23m due beyond that. Offsetting this, it had RM25.8m in cash and RM49.7m in receivables that were due within 12 months. So it actually has RM13.9m more liquid assets than total liabilities.

This surplus suggests that K. Seng Seng Corporation Berhad has a conservative balance sheet, and could probably eliminate its debt without much difficulty.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Looking at its net debt to EBITDA of 1.4 and interest cover of 3.8 times, it seems to us that K. Seng Seng Corporation Berhad is probably using debt in a pretty reasonable way. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Notably, K. Seng Seng Corporation Berhad's EBIT launched higher than Elon Musk, gaining a whopping 137% on last year. When analysing debt levels, the balance sheet is the obvious place to start. But it is K. Seng Seng Corporation Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, K. Seng Seng Corporation Berhad's free cash flow amounted to 21% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Happily, K. Seng Seng Corporation Berhad's impressive EBIT growth rate implies it has the upper hand on its debt. But, on a more sombre note, we are a little concerned by its conversion of EBIT to free cash flow. Taking all this data into account, it seems to us that K. Seng Seng Corporation Berhad takes a pretty sensible approach to debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 5 warning signs for K. Seng Seng Corporation Berhad (2 shouldn't be ignored) you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if K. Seng Seng Corporation Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:KSSC

K. Seng Seng Corporation Berhad

An investment holding company, engages in the manufacture and processing of secondary stainless steel and other metal related products in Malaysia, the Republic of Singapore, Australia, the Republic of Indonesia, and Brunei.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives