- Malaysia

- /

- Paper and Forestry Products

- /

- KLSE:EKSONS

The Price Is Right For Eksons Corporation Berhad (KLSE:EKSONS)

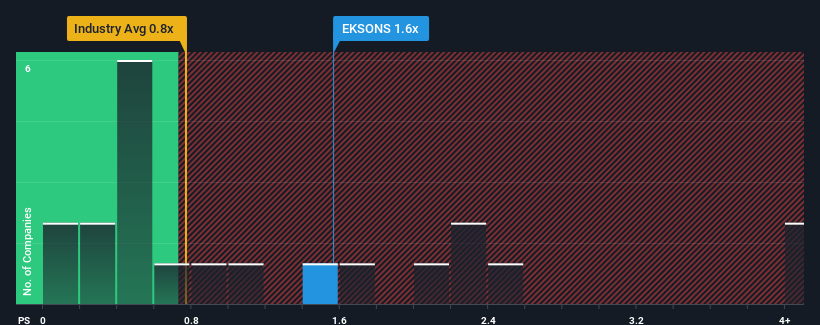

When you see that almost half of the companies in the Forestry industry in Malaysia have price-to-sales ratios (or "P/S") below 0.8x, Eksons Corporation Berhad (KLSE:EKSONS) looks to be giving off some sell signals with its 1.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Eksons Corporation Berhad

How Has Eksons Corporation Berhad Performed Recently?

For example, consider that Eksons Corporation Berhad's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Eksons Corporation Berhad, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Eksons Corporation Berhad's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Eksons Corporation Berhad's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 37% decrease to the company's top line. Still, the latest three year period has seen an excellent 35% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

When compared to the industry's one-year growth forecast of 7.5%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why Eksons Corporation Berhad's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From Eksons Corporation Berhad's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Eksons Corporation Berhad revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Eksons Corporation Berhad (1 is significant) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Eksons Corporation Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:EKSONS

Eksons Corporation Berhad

An investment holding company, manufactures and sells tropical thin plywood products in Malaysia and the Middle East.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives