- Malaysia

- /

- Paper and Forestry Products

- /

- KLSE:DOMINAN

Dominant Enterprise Berhad's (KLSE:DOMINAN) CEO Might Not Expect Shareholders To Be So Generous This Year

Shareholders will probably not be too impressed with the underwhelming results at Dominant Enterprise Berhad (KLSE:DOMINAN) recently. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 23 August 2021. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. From our analysis, we think CEO compensation may need a review in light of the recent performance.

Check out our latest analysis for Dominant Enterprise Berhad

How Does Total Compensation For Geok Owee Compare With Other Companies In The Industry?

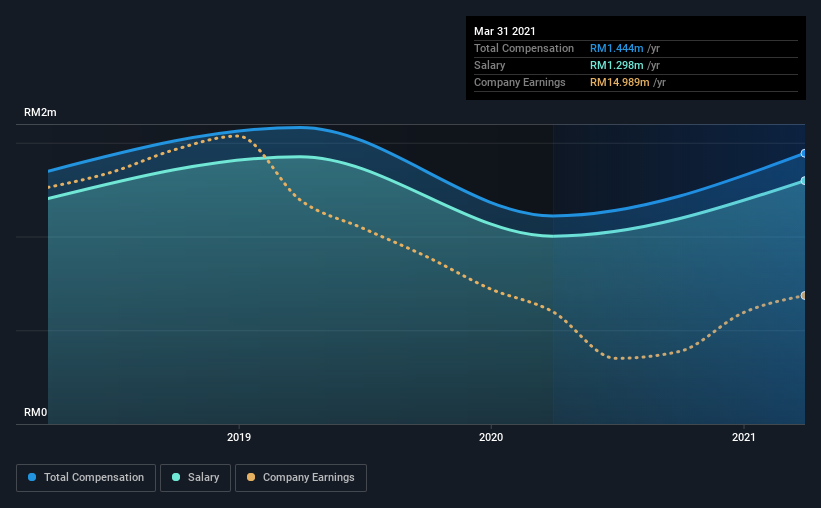

At the time of writing, our data shows that Dominant Enterprise Berhad has a market capitalization of RM129m, and reported total annual CEO compensation of RM1.4m for the year to March 2021. Notably, that's an increase of 30% over the year before. Notably, the salary which is RM1.30m, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under RM847m, the reported median total CEO compensation was RM707k. Accordingly, our analysis reveals that Dominant Enterprise Berhad pays Geok Owee north of the industry median. Furthermore, Geok Owee directly owns RM627k worth of shares in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | RM1.3m | RM1.0m | 90% |

| Other | RM146k | RM108k | 10% |

| Total Compensation | RM1.4m | RM1.1m | 100% |

On an industry level, roughly 90% of total compensation represents salary and 10% is other remuneration. Our data reveals that Dominant Enterprise Berhad allocates salary more or less in line with the wider market. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Dominant Enterprise Berhad's Growth Numbers

Dominant Enterprise Berhad has reduced its earnings per share by 18% a year over the last three years. In the last year, its revenue is down 11%.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Dominant Enterprise Berhad Been A Good Investment?

Few Dominant Enterprise Berhad shareholders would feel satisfied with the return of -32% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 4 warning signs for Dominant Enterprise Berhad you should be aware of, and 1 of them is concerning.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:DOMINAN

Dominant Enterprise Berhad

An investment holding company, manufactures and sells mouldings and furniture components, and laminated wood panel products in Malaysia, Australia, Singapore, Vietnam, and Thailand.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives