We Think Shareholders Are Less Likely To Approve A Large Pay Rise For Pacific & Orient Berhad's (KLSE:P&O) CEO For Now

Key Insights

- Pacific & Orient Berhad to hold its Annual General Meeting on 8th of March

- Salary of RM1.46m is part of CEO Thye Seng Chan's total remuneration

- The overall pay is 1,561% above the industry average

- Over the past three years, Pacific & Orient Berhad's EPS fell by 37% and over the past three years, the total shareholder return was 17%

Despite Pacific & Orient Berhad's (KLSE:P&O) share price growing positively in the past few years, the per-share earnings growth has not grown to investors' expectations, suggesting that there could be other factors at play driving the share price. The upcoming AGM on 8th of March may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

Check out our latest analysis for Pacific & Orient Berhad

How Does Total Compensation For Thye Seng Chan Compare With Other Companies In The Industry?

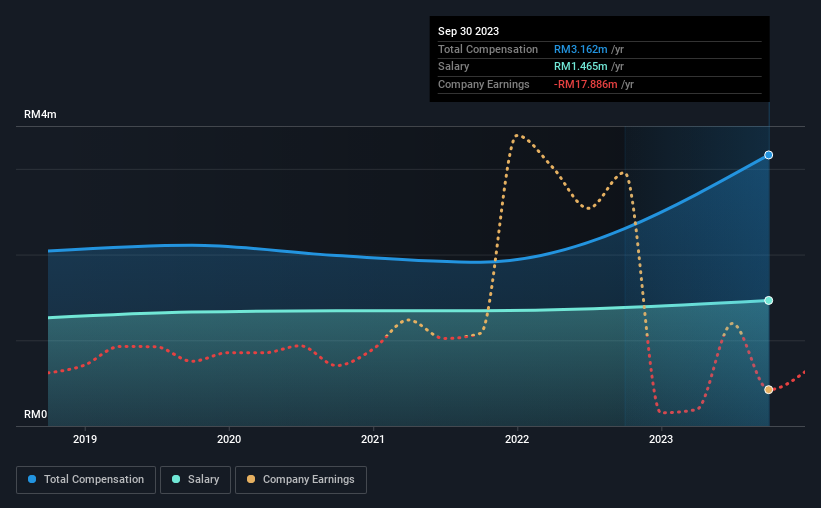

According to our data, Pacific & Orient Berhad has a market capitalization of RM251m, and paid its CEO total annual compensation worth RM3.2m over the year to September 2023. Notably, that's an increase of 65% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at RM1.5m.

On comparing similar-sized companies in the Malaysian Insurance industry with market capitalizations below RM949m, we found that the median total CEO compensation was RM190k. Accordingly, our analysis reveals that Pacific & Orient Berhad pays Thye Seng Chan north of the industry median. Moreover, Thye Seng Chan also holds RM91m worth of Pacific & Orient Berhad stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2021 | Proportion (2023) |

| Salary | RM1.5m | RM1.3m | 46% |

| Other | RM1.7m | RM567k | 54% |

| Total Compensation | RM3.2m | RM1.9m | 100% |

On an industry level, around 48% of total compensation represents salary and 52% is other remuneration. Pacific & Orient Berhad is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Pacific & Orient Berhad's Growth Numbers

Over the last three years, Pacific & Orient Berhad has shrunk its earnings per share by 37% per year. In the last year, its revenue is down 11%.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Pacific & Orient Berhad Been A Good Investment?

Pacific & Orient Berhad has served shareholders reasonably well, with a total return of 17% over three years. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

Shareholder returns, while positive, should be looked at along with earnings, which have not grown at all recently. This makes us think the share price momentum may slow in the future. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for Pacific & Orient Berhad that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:P&O

Pacific & Orient Berhad

An investment holding company, provides general insurance services in Malaysia, Thailand, United Kingdom, and the United States.

Adequate balance sheet with low risk.

Market Insights

Community Narratives