The CEO of Pacific & Orient Berhad (KLSE:P&O) is Thye Seng Chan, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Pacific & Orient Berhad.

Check out our latest analysis for Pacific & Orient Berhad

How Does Total Compensation For Thye Seng Chan Compare With Other Companies In The Industry?

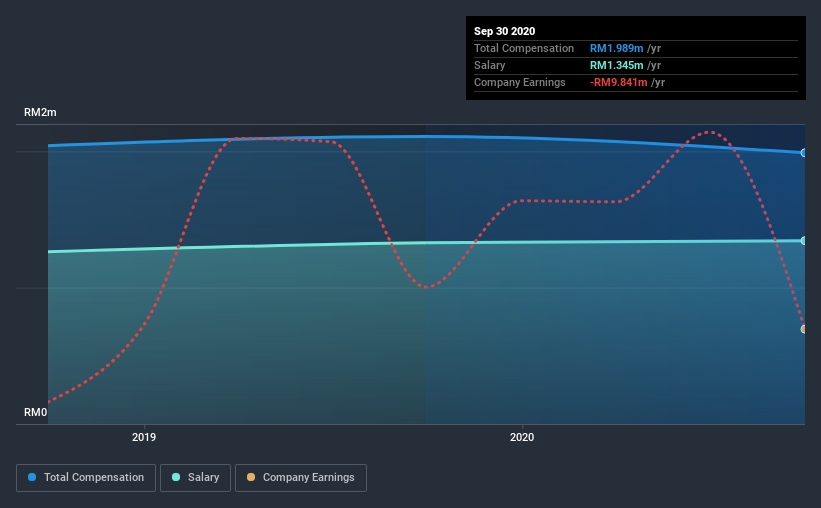

Our data indicates that Pacific & Orient Berhad has a market capitalization of RM228m, and total annual CEO compensation was reported as RM2.0m for the year to September 2020. That's a slight decrease of 5.7% on the prior year. In particular, the salary of RM1.34m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under RM809m, the reported median total CEO compensation was RM350k. Hence, we can conclude that Thye Seng Chan is remunerated higher than the industry median. Furthermore, Thye Seng Chan directly owns RM83m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | RM1.3m | RM1.3m | 68% |

| Other | RM644k | RM780k | 32% |

| Total Compensation | RM2.0m | RM2.1m | 100% |

On an industry level, roughly 68% of total compensation represents salary and 32% is other remuneration. There isn't a significant difference between Pacific & Orient Berhad and the broader market, in terms of salary allocation in the overall compensation package. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Pacific & Orient Berhad's Growth Numbers

Pacific & Orient Berhad's earnings per share (EPS) grew 17% per year over the last three years. In the last year, its revenue is down 3.9%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Pacific & Orient Berhad Been A Good Investment?

Since shareholders would have lost about 4.6% over three years, some Pacific & Orient Berhad investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As we touched on above, Pacific & Orient Berhad is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. But the company has impressed with its EPS growth, but it's disappointing to see negative shareholder returns over the same period. Considering overall performance, we can't say Thye Seng is underpaid, in fact compensation is definitely on the higher side.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 3 warning signs for Pacific & Orient Berhad (1 is a bit concerning!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Pacific & Orient Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:P&O

Pacific & Orient Berhad

An investment holding company, provides general insurance services in Malaysia, Thailand, United Kingdom, and the United States.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success