Increases to Pacific & Orient Berhad's (KLSE:P&O) CEO Compensation Might Cool off for now

CEO Thye Seng Chan has done a decent job of delivering relatively good performance at Pacific & Orient Berhad (KLSE:P&O) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 11 March 2022. However, some shareholders will still be cautious of paying the CEO excessively.

Check out our latest analysis for Pacific & Orient Berhad

How Does Total Compensation For Thye Seng Chan Compare With Other Companies In The Industry?

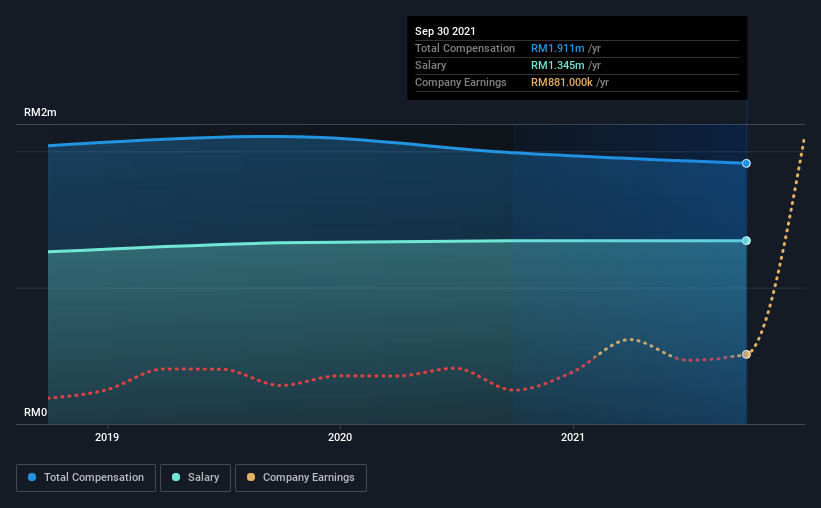

At the time of writing, our data shows that Pacific & Orient Berhad has a market capitalization of RM276m, and reported total annual CEO compensation of RM1.9m for the year to September 2021. That's a slight decrease of 3.9% on the prior year. In particular, the salary of RM1.34m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below RM837m, reported a median total CEO compensation of RM240k. Hence, we can conclude that Thye Seng Chan is remunerated higher than the industry median. What's more, Thye Seng Chan holds RM100m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | RM1.3m | RM1.3m | 70% |

| Other | RM567k | RM644k | 30% |

| Total Compensation | RM1.9m | RM2.0m | 100% |

On an industry level, around 70% of total compensation represents salary and 30% is other remuneration. Although there is a difference in how total compensation is set, Pacific & Orient Berhad more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Pacific & Orient Berhad's Growth

Over the past three years, Pacific & Orient Berhad has seen its earnings per share (EPS) grow by 119% per year. In the last year, its revenue is up 22%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Pacific & Orient Berhad Been A Good Investment?

Pacific & Orient Berhad has served shareholders reasonably well, with a total return of 27% over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 3 warning signs for Pacific & Orient Berhad (1 is a bit concerning!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:P&O

Pacific & Orient Berhad

An investment holding company, provides general insurance services in Malaysia, Thailand, United Kingdom, and the United States.

Adequate balance sheet with low risk.

Market Insights

Community Narratives