MNRB Holdings Berhad's (KLSE:MNRB) Stock Price Has Reduced 65% In The Past Three Years

Investing in stocks inevitably means buying into some companies that perform poorly. But long term MNRB Holdings Berhad (KLSE:MNRB) shareholders have had a particularly rough ride in the last three year. So they might be feeling emotional about the 65% share price collapse, in that time.

Check out our latest analysis for MNRB Holdings Berhad

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

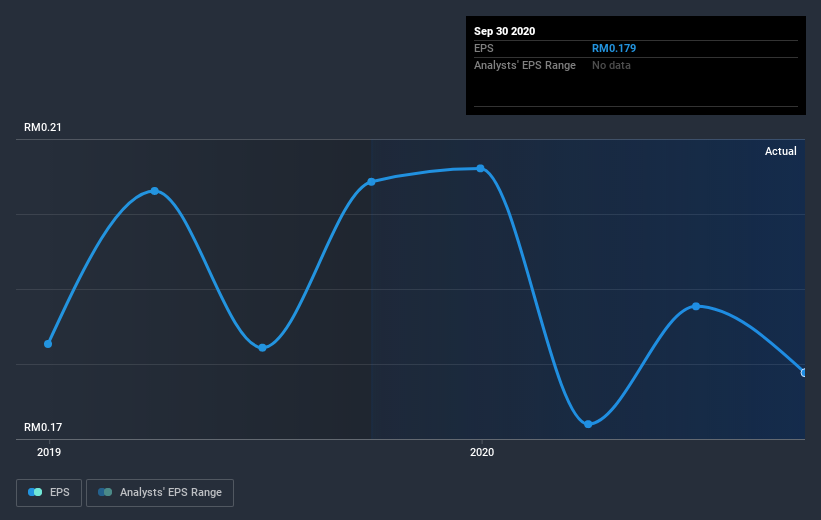

During the three years that the share price fell, MNRB Holdings Berhad's earnings per share (EPS) dropped by 20% each year. This reduction in EPS is slower than the 29% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy. This increased caution is also evident in the rather low P/E ratio, which is sitting at 5.14.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into MNRB Holdings Berhad's key metrics by checking this interactive graph of MNRB Holdings Berhad's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for MNRB Holdings Berhad the TSR over the last 3 years was -60%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

MNRB Holdings Berhad shareholders are down 12% for the year (even including dividends), but the market itself is up 6.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 8% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for MNRB Holdings Berhad you should be aware of.

Of course MNRB Holdings Berhad may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you decide to trade MNRB Holdings Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:MNRB

MNRB Holdings Berhad

An investment holding company, engages in the general reinsurance, takaful, and retakaful businesses in Malaysia and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives