- Malaysia

- /

- Hospitality

- /

- KLSE:MAA

What Are The Total Returns Earned By Shareholders Of MAA Group Berhad (KLSE:MAA) On Their Investment?

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But even in a market-beating portfolio, some stocks will lag the market. While the MAA Group Berhad (KLSE:MAA) share price is down 19% over half a decade, the total return to shareholders (which includes dividends) was 53%. That's better than the market which declined 14% over the same time. There was little comfort for shareholders in the last week as the price declined a further 1.3%.

View our latest analysis for MAA Group Berhad

Given that MAA Group Berhad didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over five years, MAA Group Berhad grew its revenue at 33% per year. That's better than most loss-making companies. The share price drop of 3% per year over five years would be considered let down. So you might argue the MAA Group Berhad should get more credit for its rather impressive revenue growth over the period. If that's the case, now might be the smart time to take a close look at it.

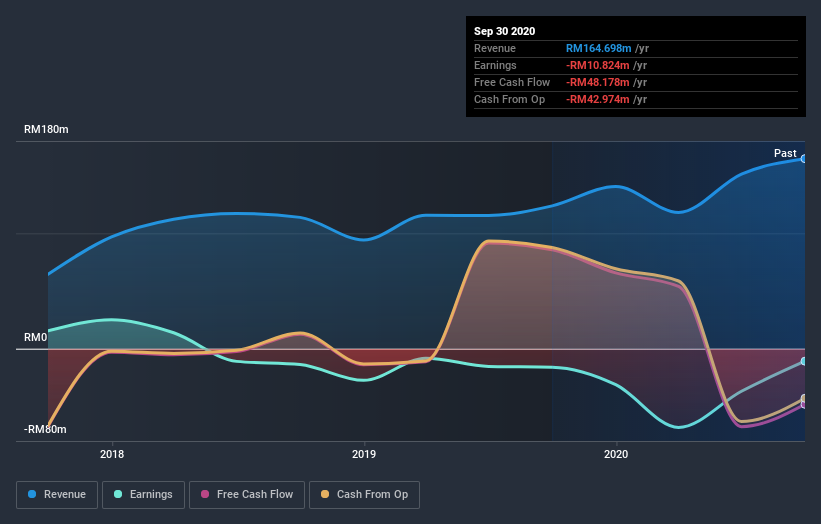

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of MAA Group Berhad, it has a TSR of 53% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

While the broader market gained around 7.4% in the last year, MAA Group Berhad shareholders lost 1.9% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 9%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand MAA Group Berhad better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with MAA Group Berhad (at least 1 which is significant) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

When trading MAA Group Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:MAA

MAA Group Berhad

An investment holding company, provides hospitality services in Malaysia and the Philippines.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives