- Malaysia

- /

- Medical Equipment

- /

- KLSE:SUPERMX

News Flash: Analysts Just Made A Meaningful Upgrade To Their Supermax Corporation Berhad (KLSE:SUPERMX) Forecasts

Celebrations may be in order for Supermax Corporation Berhad (KLSE:SUPERMX) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with the analysts modelling a real improvement in business performance. The market seems to be pricing in some improvement in the business too, with the stock up 6.5% over the past week, closing at RM7.08. Could this big upgrade push the stock even higher?

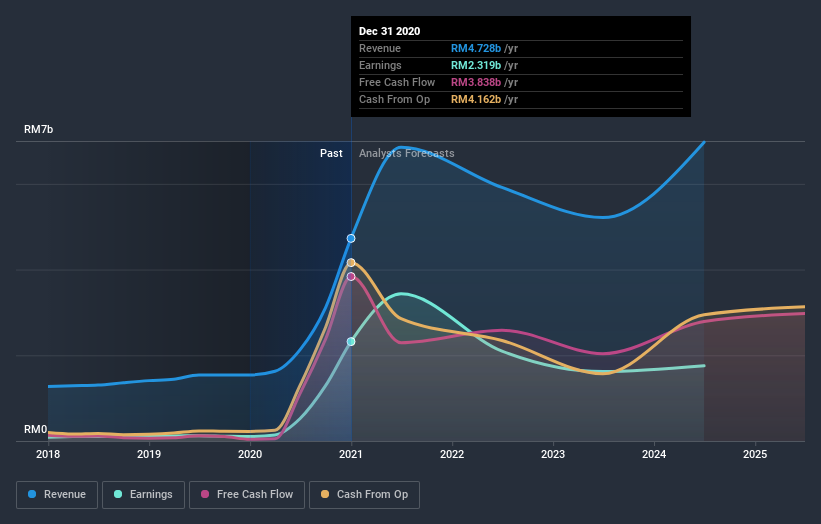

After this upgrade, Supermax Corporation Berhad's nine analysts are now forecasting revenues of RM7.5b in 2021. This would be a huge 59% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to jump 66% to RM1.48. Before this latest update, the analysts had been forecasting revenues of RM6.6b and earnings per share (EPS) of RM1.21 in 2021. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

View our latest analysis for Supermax Corporation Berhad

As a result, it might be a surprise to see that the analysts have cut their price target 15% to RM10.62, which could suggest the forecast improvement in performance is not expected to last. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Supermax Corporation Berhad analyst has a price target of RM16.40 per share, while the most pessimistic values it at RM9.05. This is a fairly broad spread of estimates, suggesting that the analysts are forecasting a wide range of possible outcomes for the business.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. The analysts are definitely expecting Supermax Corporation Berhad's growth to accelerate, with the forecast 59% growth ranking favourably alongside historical growth of 40% per annum over the past three years. Compare this with other companies in the same industry, which are forecast to grow their revenue 15% next year. Factoring in the forecast acceleration in revenue, it's pretty clear that Supermax Corporation Berhad is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. The declining price target is a puzzle, but still - with a serious upgrade to this year's expectations, it might be time to take another look at Supermax Corporation Berhad.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Supermax Corporation Berhad going out to 2024, and you can see them free on our platform here..

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you’re looking to trade Supermax Corporation Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:SUPERMX

Supermax Corporation Berhad

An investment holding company, manufactures, distributes, and markets medical gloves and contact lenses in Europe, North America, Central America, South America, Asia, Oceania, and Africa.

High growth potential with adequate balance sheet.